UGC NET MICRO ECONOMICS MATERIAL

CONCEPT OF DEMAND

The concept of demand was given by Alfred Marshall in 1890s in his

book “Principles of Economics”. According to him, the demand can

be represented by following words:

1. Desire

2. Willingness

3. Ability to pay for the commodity

4. Price of the commodity

5. Time

Law of Demand

The law of demand was given by Alfred Marshall. It is a partial equilibrium analysis and

states that there is an inverse relationship between price of the commodity and the quantity

demanded of it.

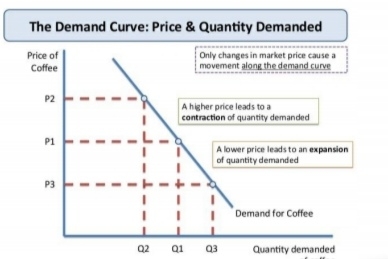

Demand Curve: It is the graphical presentation of the law of demand

Demand Schedule: It is the tabular presentation of the law of demand.

Market Demand: It is the horizontal summation of individual demands. It is affected by the

population levels. Market demand curve is flatter as compared to the individual demand.

Reasons for downward sloping demand curve

1. Law of Diminishing Marginal Utility: This states that the marginal

utility of a good or service declines as its available supply increases.

2. Income effect: The change in consumer’s purchases of the goods as a

result of a change in their money income

3. Substitution effect: Effect of a change in the relative prices of goods

on consumption pattern

4. Different uses of a commodity

5. Size of the market

Exceptions to the Law of Demand

1. Veblen Effect: Goods having prestige value. Veblen

propounded the doctrine of conspicuous consumption. Higher

the price of the commodity, more will be the prestige derived

from it

2. Giffen goods: The demand curve for a giffen goods is an

upward sloping curve

3. Ignorance

4. Expectations

5. War

Bandwagon Effect: It arises because individuals demand

commodities because others are doing so, or in simple words, it is in

fashion.

Snob Effect: It arises due to the desire to purchase a commodity

having prestige value so as to look different or exclusive than others.

CHANGES IN DEMAND

Increase or Decrease in Demand

• Leads to shift in the demand curve.

• Caused by Shift Factors of Demand (Factors other than price)

Expansion or Contraction of Demand

• Leads to movement in the demand curve.

• Caused due to price.

Demand for Durable goods

• Durable goods can be stored, hence the prices

are not volatile.

• Consumption can be postponed.

Derived Demand

It is the demand for goods which are used to produce other goods. Example Labour.

ELASTICITY OF DEMAND

The concept of elasticity of demand was given by Marshall.

Elasticity of demand measures the responsiveness or change in

demand due to factors like price, income, price of related goods,

etc.

Price elasticity : Price elasticity is the proportionate change in

quantity demanded divided by the proportionate change in price.

Degrees of Price Elasticity:

Unitary Elastic e=1

Elastic e>1

Inelastic e<1

Perfectly Elastic e=Infinity

Perfectly Inelastic e=0

Measurement of Price Elasticity of Demand

a. Proportionate or Percentage Method: Here, the price elasticity is

measured by its coefficient Ep. This measures the percentage change

in the quantity of a commodity demanded resulting from a given

percentage change in its price.

b. Point Elasticity Method = 𝑳𝒐𝒘𝒆𝒓 𝑺𝒆𝒈𝒎𝒆𝒏𝒕 /𝑼𝒑𝒑𝒆𝒓 𝑺𝒆𝒈𝒎𝒆𝒏𝒕

c. Arc Elasticity Method: It is used when price and quantity

changes are somewhat large. It is the measure of the average

responsiveness to price change exhibited by a demand curve over

some finite stretch of the curve

d. Total Expenditure Method: Evolved by Marshall. By comparing

the total expenditure of a purchaser both before and after the

change in price, it can be known whether their demand for a good

is elastic, unity or inelastic.

e. Revenue Method: Elasticity will be measure in this method using

the concepts of AR and MR. e= AR/(AR-MR)

Income Elasticity: It is the responsiveness of change in quantity

demanded due to change in income levels.

Normal Good (ey) > 0

Inferior goods (ey) < 0

Luxuries (ey) > 1

Necessities 0 < ey < 1

Engel curve: Engel curve is the graphical presentation of relationship

between income and quantity demanded.

Necessities (+ve relation)

Luxuries (+ve relation)

Inferior goods (+ve relation)

Cross Elasticity of Demand measures the degree of responsiveness

of change in the demand for one good in response to the change in

price of another good.

Ec = 𝐏𝐫𝐨𝐩𝐨𝐫𝐭𝐢𝐨𝐧𝐚𝐭𝐞 𝐜𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐪𝐮𝐚𝐧𝐭𝐢𝐭𝐲 𝐝𝐞𝐦𝐚𝐧𝐝𝐞𝐝 𝐨𝐟 𝐗 /

𝐏𝐫𝐨𝐩𝐨𝐫𝐭𝐢𝐨𝐧𝐚𝐭𝐞 𝐜𝐡𝐚𝐧𝐠𝐞 𝐢𝐧 𝐭𝐡𝐞 𝐩𝐫𝐢𝐜𝐞 𝐨𝐟 𝐠𝐨𝐨𝐝 𝐘

Goods Cross Elasticity

1. Substitutes Positive

2. Complements Negative

3. Unrelated Zero

QUESTIONS FOR CLARITY

1. The value of the best alternative forgone when a decision is made defines

(A) economic good.

(B) opportunity cost.

(C) scarcity.

(D) trade-off.

2. Which of the following problems do all economic systems face?

I. How to allocate scarce resources among unlimited wants

II. How to distribute income equally among all the citizens

III. How to decentralize markets

IV. How to decide what to produce, how to produce and for whom to produce

(A) I only

(B) I and IV only

(C) II and III only

(D) I, II and III only

3. A downward sloping demand curve can be explained by

I. diminishing marginal utility. II. diminishing marginal returns.

III. the substitution effect. IV. the income effect.

(A) I only

(B) I and III only

(C) I and IV only

(D) I, III and IV only

4. Which of the following will not change the demand for oranges?

(A) A change in consumer’s incomes

(B) A change in the price of oranges

(C)A change in consumer’s taste for oranges

(D) All the above changes the demand for oranges

5. If hot dogs are an inferior good, an increase in income will result in

(A) An increase in the quantity demanded for hot dogs.

(B) A decrease in the quantity demanded for hot dogs.

(C) No change in the quantity demanded for hot dogs.

(D) None if the above

Answers :

1) B 2) B 3) D 4) D 5) B

THEORIES OF DEMAND

1. Cardinal or Marshallian Analysis

Cardinal school is the oldest school in case of theories of demand.

Concept of Utility was originally given by Bentham, however, it was formally

introduced by Jevons. He defined utility as the power of a commodity or service to

satisfy human wants.

Assumptions of cardinal analysis are as follows:

a. Utility can be measured.

b. Consumer is rational

c. Money is a measuring mode of utility.

d. Marginal utility of money is constant: The concept of Marginal Utility of money was

given by Daniel Bernoulli.

e. Utilities are additive in nature.

f. Utilities are independent.

g. It is based on introspection.

Theories under Marshallian Analysis

a. Law of Diminishing Marginal Utility: It is also known as Gossen's First law.

Law of Diminishing Marginal Utility states that as the consumer consumes more and

more of a commodity, the marginal utility derived on consuming each additional unit

keeps on declining.

Total Utility (TU): Total utility is the total satisfaction achieved after consuming all the

units of a particular commodity.

Marginal Utility (MU): Marginal Utility is the additional or incremental utility achieved

after consuming additional unit of a commodity.

“Marginal Utility curve is simply the slope of the total utility curve”.

Marginal Utility explains the relationship between demand and price.

It explains the paradox of value. Marginal utility determines the price of a commodity

and not the total utility.

b. Law of Equi-Marginal Utility: It is also known as Gossen’s Second Law. The law

states that the marginal utility derived should be equal to that derived from the last

rupee spent.

The law is more associated with the consumer’s equilibrium. Consumer will reach the

equilibrium point when:-

• In case of single good: MUx = Px

• In case of several goods: MUm = (MUx/Px) = MUy/Py = ……

2. Ordinal or Hicksian Analysis : Utilities cannot be measured.

Assumptions of the theory:

a. Utilities can be ranked.

b. Consumer is rational.

c. Indifference curve is based on weak ordering, that is, it considers both preferences and

indifference.

d. The consumption follows a transitive pattern.

e. Continuity: The consumption follows a smooth continuous curve which can be drawn.

f. Diminishing Marginal Rate of Substitution: MRSXY = ΔY/ΔX = MUx / MUY

Note: MRSXY is also the slope of Indifference curves.

Indifference curves

The convex shape of IC shows

diminishing MRS.

Indifference Map: Set of ICs

Why the MRS is decreasing?

• Want of the good is satiable.

• Goods are imperfect substitutes of

each other.

Shapes of Indifference Curves are:

Perfect Substitutes: Straight line

Perfect Compliments: L Shaped

Budget Line(Price Line)

When there is a change in income levels, it leads to shift in the budget line. When there is

a change in prices, it will lead to the movement in the budget line.

Consumer Equilibrium

It is the point of tangency between Indifference curve and budget line

MRSXY = MUX / MUY = (-) PX / PY

Conditions for consumer equilibrium

First Order Condition: MRSXY = MUX / MUY = (-) PX / PY

Income Effect

To trace the income effect, we have an Income Consumption curve which shows the changes in

consumer equilibrium with changes in income.

Note:- Normal goods are those whose consumption increases with increase in income, while

inferior goods are those whose consumption decreases due to increase in income.

Substitution Effect

Substitution effect traces the changes in consumption of commodities when the relative prices

change.

In case of tracing the substitution effect, we keep the real income as constant so that we can

know the relative change in the prices

Price Effect

Price effect is the change in demand due to change in the price of the commodity, other things

remaining the same. To trace the changes in price effect, we have price consumption curve.

Price Effect = Income Effect + Substitution Effect

Hints for Decomposition of Price Effect into Income Effect and Substitution Effect:-

Goods Price Effect Income Effect Sub. Effect

1. Normal Negative Positive Negative

2. Inferior Negative (I.E.<S.E.) Negative Negative

3. Giffen Positive (I.E. > S.E.) Negative Negative

3. Revealed Preference Theory: The theory was given by Samuelson in 1938. It is a form

of ordinal ranking and is based on the concept of strong ordering. The theory is behavior

based and the choice of the consumer reveals the preference.

Assumptions of the theory are:

a. Consistency

b. Transitivity

c. Choice is always made

d. Income will be fully spent.

e. More is preferred to less.

Indirect Revealed Preference

In this case more than two goods are involved. For example, if A is preferred to B, and B is

preferred to C, then A is indirectly preferred to C.

Indifference curve uses real income for estimating the level of satisfaction whereas revealed

preference theory uses real income for estimating the purchasing power

Fundamental Theorem of Consumption

The theorem was given by Samuelson. It states that price and quantity will be negatively

related if we have positive income effect of demand.

In case of indifference curve analysis, real income is used in the sense of level of satisfaction.

In case of revealed preference, real income is used in the sense of purchasing power.

4. Hicks’ Logical Ordering

This theory is the revised version of Hicks’ own theory in his work “A Revision of

Demand Theory” in 1956. He was influenced by Samuelson’s work and hence used

econometrics in his theory, keeping the original assumption that utility is ordinal in nature.

5. Consumer Behaviour Under Uncertainty

The theory was propounded by Neumann and Morgenstern and is commonly known as

N-M

Utility Index. They have considered the role of both risk and uncertainty.

Expected utility of a lottery can be calculated using the weighted sum of the utilities

associated with the outcomes with probabilities acting as weights.

E(U(L)) = P1 (U(A)) + (1-P1)(U(B))

For a risk averse person, U[E(L)] is greater than E[U(L)] and marginal utility of money is

falling.

For a risk lover, U[E(L)] is less than E[U(L)] and marginal utility of money is rising.

For a risk neutral person, U[E(L)] is equal to E[U(L)] and marginal utility for money is

constant through all income levels.

Risk premium is to protect the risk averse person to avoid risk.

Two measures of risk aversion were given by Arrow and Pratt.

a. Absolute measure: It is measured using the formula:

[-U’’(W)/U’(W)]

where, W is a measure of wealth

[-U’’(W)/U’(W)] is positive Risk Averse

[-U’’(W)/U’(W)] is negative Risk Lover

[-U’’(W)/U’(W)] is zero Risk Neutral

b. Relative measure: It helps in comparing the attitude of workers towards risk and is

measured using the formula

W*RA

Where, RA is the relative attitude towards risk.

Bernoulli’s hypothesis: The theory assumes that majority of the population is risk averse

and hence marginal utility of money is declining. For the risk averse person, the effect of

gain received from the lottery will be less than the effect of loss incurred and hence he

will never choose a 50- 50 probability.

Friedman-Savage Hypothesis: According to this theory, the marginal utility will not be

constant over the entire range, that is, it will both increase and decrease. The attitude of

the consumer would depend on whether the marginal utility of money is increasing or

decreasing.

Markowitz Theory: According to his theory, there can be both risk lovers as well as risk

averse individuals. The marginal utility of money will not be constant over the entire

range. However, in his theory, small increases or decreases in income will increase the

marginal utility of money but large changes in income will always lead to decrease in

marginal utility of money.

St. Petersburg Lottery/Paradox: The paradox states that when the number of participants

are less, then this might lead to infinite expected value. In the case, an individual will always

accept the lottery.

Investor Choice Problem : Budget constraint will be an upward sloping line because there

is a positive trade-off between risk and return.

QUESTIONS FOR CLARIFICATION

1. Which of the following is an example of a normative statement?

(a) Since this good is bad for you, you should not consume it.

(b) This good is bad for you.

(c) If you consume this good, you will get sick.

(d) People usually get sick after consuming this good.

2. Suppose the demand curve for a good shifts rightward, causing the equilibrium price to

increase. This increase in the price of the good results in

(a) a rightward shift of the supply curve.

(b) an increase in quantity supplied.

(c) a leftward shift of the supply curve.

(d) a leftward movement along the supply curve.

3. Equilibrium is defined as a situation in which

(a) neither buyers nor sellers want to change their behavior.

(b) no government regulations exist.

(c) demand curves are perfectly horizontal.

(d) suppliers will supply any amount that buyers wish to buy.

4. The change in price that results from a leftward shift of the supply curve will be greater if

(a) the demand curve is relatively flat than if the demand curve is relatively steep.

(b) ) the demand curve is relatively steep than if the demand curve is relatively flat.

(c) the demand curve is horizontal than if the demand curve is vertical.

(d) the demand curve is horizontal than if the demand curve is downward sloping.

5. If the price elasticity of demand for a good is less than one in absolute terms, we say

consumers of this good

(a) are not very sensitive to price.

(b) are not very sensitive to the quantity they demand.

(c) are very sensitive to price.

(d) are elastic.

Answers:-

1) A 2) B 3) A 4) B 5) A

PRODUCTION THEORY

A production function shows the technical relationship between the inputs and outputs.

Q=f(L,K)

Assumptions of production function are:

1. State of technology is assumed to be constant.

2. Production function is with reference to a particular period of time.

Production function

1 factor variable, others fixed

(Law of variable prop. because proportion varies, SR law)

All factors variable

(Returns to scale of inputs, LR Law)

Law of Variable Proportions/Returns to a Factor

It is a short run theory in which there is atleast one factor which is fixed, that is, it cannot change.

Thus, this law deals with the changes in the factor proportions.

Beyond a certain point, the MP of the factor would diminish.

Assumptions :- (1) Tech is fixed and constant

(2) Some inputs should be ript constant

(3) Various factors can be combined to produce

Stages of Law of Variable Proportions

Stage 1: Increasing returns to a factor

Under this stage the marginal product increases, reaches maximum and starts decreasing. The

stage ends

where the average product reaches maximum.

In this stage MP of the fixed factor is negative.

Stage 2: Diminishing returns to a factor

Under this stage, the marginal product decreases, average product starts falling. The stage ends

when

marginal product reaches zero.

Stage 3: Negative Returns to a Factor

Under this stage, the marginal product of the variable factor becomes negative as a result of

which the total product starts falling.

NB:- A point to remember here is that in stage 1, the marginal product of fixed factor is negative

because it is in excess of the variable factor. On the other hand, in stage 3, the marginal product

of a variable factor is negative because it is in excess of the fixed factor.

Isoquants/Equal Product Curves/Iso-Product Curves

Isoquants is the locus of various combinations of input producing the same level of output.

MRTS Slope of isoquants

• No of units of capital gives up to get me unit of labour, output to be the same.

• Diminishing is nature (Convexity)

If isoquant is concave linear, the optimum production would be at a corner solution

Elasticity of Substitution

1. Perfect substitutes: Marginal Rate of technical substitution is constant and elasticity of

substitution is equal to infinity.

2. Perfect Complements: Marginal rate of technical substitution is zero and elasticity of

substitution is also equal to zero.

Types of Production Functions

1. Linearly Homogenous Production Function

Q = f(L,K)

If we multiply the production function with a constant say m, Q = f(mL, mK)

Taking m to be common, we get; Q = m.f(L,K)

Q= m.Q

Anything raise to the power m, gives us the degree of homogeneity.

2. Cobb-Douglous Production Function

It was given in 1928 and is represented as follows:

Q = ALαKβ

Where:

Q = Output level, A = State of Technology, L = Labour, K = Capital, α = Share of Labour in

production, β = Share of capital in production

The features of C-D production function are:

• Linearly Homogenous Production Function

• Constant Returns to Scale

• Elasticity of Substitution is equal to one

• α tells the output or production elasticity of labour, β tells the output or production elasticity of

capital and they both are constant.

α + β = 1 Constant Returns to Scale

α + β > 1 Increasing Returns to Scale

α + β < 1 Decreasing Returns to Scale

Euler’s Theorem: If the factors are paid on the basis of their marginal productivity, then

ultimately the total output will be exhausted. It holds true in linearly homogenous production

function.

MPL * L + MPK * K = Q

3. CES Production Function

It was given in 1961 by Arrow, Minhas, Chenery and Solow

Q = Ɣ[ϨL-ϱ + (1-Ϩ)K-ϱ] -1/ ϱ

Where

Ɣ = Coefficient of technical efficiency; Ɣ > 0

Ϩ = Distribution Parameter; 0 < Ϩ < 1

ϱ = Substitution parameter

Elasticity of Substitution = 𝟏 /(𝟏+𝛠)

Ridge Lines: Ridge lines are the locus of points where marginal productivity of atleast one factor

is zero.

Isoclines: Isoclines is the locus of points in which marginal productivity of inputs is kept constant.

There are two ridge lines A and B. At A, the marginal

productivity of capital is zero and points above A

show negative marginal productivity of capital.

At B, the marginal productivity of B is Zero and is

negative at all points below it.

The optimum stage of production is the region between the two ridge lines and hence is

called the region of economic production.

Returns to Scale

It is a long run law in which all the factors are variable in nature and factor proportions do not

change. All inputs will be varied by the same proportion.

Stages of Returns to Scale

1. Constant Returns to Scale: Under this, the change in proportion of inputs is equal to the

change in proportion of outputs. Isoquants are equi-distant

2. Decreasing Returns to Scale: Under this, the change in proportion of inputs is greater than the

proportionate change in outputs. The distance between the isoquants keep increasing.

3. Increasing Returns to Scale: Under this, the change in proportion of inputs is less than the

change in proportion in outputs. The distance between the isoquants would keep decreasing.

Economies of Scale

• Reasons for Increasing, Decreasing or Constant Returns to Scale are explained by the

Economies of Scale.

Internal Economies of Scale Firm Based

External Economies of Scale Industry Based

Real Economies: Real economies are experienced when we reduce the quantity purchased of our

physical inputs.

Pecuniary Economies: Pecuniary economies are experienced when we purchase large quantities

of physical inputs so that the overall price paid is less. For example, wholesale prices.

Relationship between Returns to Scale and Returns to a factor

Returns to Scale When Capital is held constant

Constant Returns to scale Returns to a factor say MPL will diminish when capital is

held constant.

Decreasing Returns to scale Returns to a factor MPL will diminish at a rapid pace.

Increasing Returns to scale There can be two possibilities:

1. If there are strong increasing returns to scale then

returns to a factor MPL will increase.

2. If there is a slight increasing returns to a scale then

returns to a factor MPL will decrease.

Single Product Firm

For a firm producing single output, equilibrium will occur at the point of tangency of

isoquant and the iso- revenue line

Multi-product Firm

Production Possibility Frontier: It is the combination of two goods which can be produced

given the technology or level of resources.

Iso-Revenue line: It is the locus of points of combination of two goods produced which generate

equal revenue.

Slope of PPC is the Marginal Rate of Product Transformation (MRPT) which is increasing

because different resources are suited to produce different goods.

MRPTXY = 𝐌𝐂𝐱 / 𝐌𝐂𝐲

Equilibrium point will occur where MRPTXY = 𝐌𝐂𝐱 / MCy= 𝐏x / 𝐏𝐲

Expansion Path: It is the locus of point of revenue maximisation. It is also known as scale line

because it tells how firms change their scale of production.

Price Effect

In case of production theory, the price effect is the sum of output effect and substitution

effect.

In case when factors of production are substitutable, then substitution effect is greater than the

output effect implying that, if price of labor decreases, then labor would be used more as

compared to the other input.

In case the goods are complementary, then output effect is more than the substitution effect

implying that with decrease in price of labor, more of both factors will be used.

Technical Efficiency: It implies maximizing the output with given inputs.

Economic Efficiency: It implies minimizing the cost to produce a given level of input.

Theory of Cost

In short run, we assume one factor of production to be variable and rest all are fixed.

In the long run, we assume technology and prices to be constant.

Shift Factors: These are the factors shifting the cost function other than the output.

In the long run, technology and prices are the shift factors

In the short run, the fixed factors are considered to be the shift factors.

Types of Cost

1. Explicit Cost: It is also known as the accounting cost, private opportunity cost. These costs are

out of the firm or cost of hiring a factor of production.

2. Implicit Cost: Also known as the imputed cost. These are the prices of owned services and are

included in the average cost.

3. Economic Cost: It is the sum of explicit and implicit cost.

4. Opportunity Cost: It is the cost of next best alternative and is a part of implicit cost. It is also

known as transfer earnings.

5. Historical Cost: It is the original price of the factor of production when bought in the past. It is

irrelevant in the production process.

6. Sunk Cost: It is a kind of historical cost which cannot be recovered. Even sunk costs are not

relevant to decision making.

Economic Profits = Total Revenue = Economic Costs

Total Cost = Total Fixed Cost + Total Variable cost

Average Cost = Average Fixed Cost + Average Variable Cost

Marginal cost is the change in Total cost due to the change in inputs used for production

Relationship between Average Cost and Marginal Cost

When AC is falling, marginal cost is falling more than AC. When AC is minimum, AC = MC

When AC is rising, MC rises more than AC

Long Run Costs

Long Run Costs are less than or equal to short run costs, and are hence flatter as compared to the

short run costs.

Long Run Average cost curve is also known as the planning curve. Plants are used at less than

full capacity at point left to the minimum point and are used at more than full capacity at points

right to the minimum point. The optimum plant size is when it operates at minimum LAC.

Recent Developments in the Cost Theory

1. Saucer Shaped LAC

The shape is such due to the reserve capacity

Reserve Capacity: Saucer shaped Cost curve is due to the existence of reserve capacity of the

firm. This portion indicates a horizontal portion in the average cost curves.

2. L-Shaped or continuously falling LAC curve

The reasons for continuously falling LAC curve are:

a. Economies of Scale b. Technological Progress

3. Learning Curve: This was given by Kenneth Arrow.

It includes the concept of learning by doing. It states that the increase in cumulative output leads

to decline in per unit cost due to learning by doing.

Economies of Scope: Joint production of a good is more efficient than the separate production

by two firms producing the same good.

Diseconomies of Scope: Joint production is less than the individual production.

QUESTIONS FOR CLARITY

1. An isoquant curve shows

a. all the alternative combinations of two inputs that yield the same maximum total product.

b. all the alternative combinations of two products that can be produced by using a given set of

inputs fully and in the best possible way.

c. all the alternative combinations of two products among which a producer is indifferent because

they yield the same profit.

d. both (b) and (c).

The Marginal rate of technical substitution is

2. the rate at which a producer is able to exchange, without affecting the quantity of output

produced, a little bit of one input for a little bit of another input.

b. the rate at which a producer is able to exchange, without affecting the total cost of inputs, a

little bit of one input for a little bit of another input.

c. the rate at which a producer is able to exchange, without affecting the total inputs used, a little

bit of one output for a little bit of another output.

d. a measure of the ease or difficulty with which a producer can substitute one technique of

production for another

3. For a given short-run production function,

a. technology is assumed to change as capital stock changes.

b. technology is assumed to change as the labor input changes.

c. technology is considered to be constant for a given production function relationship.

d. technology is assumed to change positively until diminishing returns set in and then it changes

in the other direction.

4. A tangency point between an isoquant and an isocost line identifies

a. the least costly combination of inputs required to produce various levels of outputs.

b. the various levels of output that can be produced using a given level of inputs.

c. the various combinations of inputs that can be used to produce a given level of output.

d. the least costly combination of inputs required to produce a given level of output.

5. If a profit-maximizing firm’s marginal product of labor equals 1 ton of output, while the

marginal product of

capital equals 7 tons of output and the use of capital is priced at $14 per unit, then

a. the price of labor must be $2.

b. the price of labor must be $7.

c. the price of labor must be $14 as well.

d. none of the above is true.

6. Which of the following statements about marginal cost is incorrect?

a. A U-shaped marginal cost curve implies the existence of diminishing returns over all ranges of

output.

b. When marginal cost equals average cost, average cost is at its minimum.

c. In the short run, the shape of the marginal cost curve is due to the law of diminishing marginal

returns.

d. When marginal cost is falling, total cost is rising.

7. Which of the following statements about the relationship between marginal cost and average

cost is correct?

a. When MC is falling, AC is falling.

b. AC equals MC and MC’s lowest point.

c. When MC exceeds AC, AC must be rising.

d. When AC exceeds MC, MC must be rising.

Answers:-

1)A 2)A 3)C 4)D 5)A 6)A 7)C

MARKET STRUCTURES

Types of Markets:- 1. Perfect Competition

2. Monopoly

3. Oligopoly

4. Monopolistic Competition

1. Perfect Competition

Features of perfect competition are:

a. Large number of buyers and sellers. b. Free entry and exit. c. Perfect information.

d. No transport cost. e. Homogenous Product

Perfect Competition vs Pure Competition

Perfect competition is a wider concept and is perfect in all contexts. On the other hand, pure

competition is a narrower concept in which there is freedom from monopoly errors and freedom

from entry and exit.

Time element

Marshall gave the concept and he divided time on the basis of response of supply

(1) Market period /very short time period – supply fixed and there are no adjustments

(2) Short period – Expand output with given equipment No change in plants or given capital.

(3) Long period – New entry and exit, New plants/abandon old ones, Full adjustment of all factors

and all costs.

Under Perfect Competition, MR = AR = Price

Short Run Equilibrium

Two conditions need to be satisfied for attaining the equilibrium level:

1. Marginal Cost (MC) = Marginal Revenue (MR)

2. MC should cut MR from below

• In the Short run, there are 3 possibilities

1. Super Normal Profits 2. Normal Profits 3. Losses

Long run

In the long run, a perfectly competitive industry earns only normal profits, that is,

Price = AR = MR = LMC = LAC = SAC = SMC

Important:-

❑ A perfectly competitive firm does not quit the industry even if it incurs losses in the short run

because they can’t alter the fixed capital equipment in the short run. As a result, they will have

to incur the losses equal to fixed cost even when they shut down. Thus, they continue

production in the short run even when they incur losses.

❑ A perfectly competitive firm is in business even when economic profits are zero because

economic profits include the opportunity costs. So at zero economic profits, firms still earn a

return on capital invested. So at zero economic profits, the firms still earn a return on the

capital invested.

Consumer surplus :- Price consumers are

willing to pay- what they actually pay

Producer’s surplus :- Mkt price at which

sellers sell min price they are willing to sell.

❑ This diagram explains the consumer

surplus and producer surplus explained

by Marshall

❑ Hicks also analyzed the Consumers

Surplus based on indifference curve analysis

2. Monopoly

Features:

a. Single seller b. No close substitutes c. Barriers to prohibit the entry of new firms.

d. Affects no other seller by its own action. e. Firm and industry are one single entity.

f. The demand curve in case of a monopolist is a downward sloping curve.

Pure Monopoly

Single Seller, no substitutes, cross elasticity = 0, price elasticity = 1. Thus Total revenue remains

constant

Natural Monopoly

Single Seller, the good produced has substitutes, cross elasticity is low.

Legal/Statutory Monopoly: The government provides the legal status through patents or

copyrights.

Price and Marginal Cost under Monopoly

Price difference from MC = f (Price elasticity

at that point on AR curve) Smaller the

elasticity, greater the difference between

price and MC. Therefore,

Monopoly price = f (MC, Price elasticity)

Where, Monopoly price and MC are

positively related, and Price elasticity

and Monopoly price are negatively related.

Monopoly Equilibrium And price Elasticity of Demand

Monopolist will never be in when ep < 1 We know,

MR = AR [(e-1)/e]

So when e < 1, MR becomes negative, implying a fall in total revenue. So it will not be rational for

the monopolist to operate at a point where Marginal revenue is negative.

NB: When the marginal cost is zero, monopolist operates at the point

where price elasticity of demand is equal to one.

❑ Average revenue is decreasing because more can be sold at lower price. MR is below AR

because its fall is twice the fall of AR. Therefore, Price is more than marginal cost.

❑ Cost curves remain the same.

❑ There is no supply curve in monopoly. No unique price-quantity relationship

Short Run:

Conditions of equilibrium

1. MR = MC

2. MC should cut MR curve from below

In short run, a monopolist can earn super-normal profits, normal profits or can even incur losses.

Long Run: In the long run, a monopolist earns only super normal profits because there are no

barriers to entry.

Conditions for equilibrium:

a. Short run Average cost = Long run Average Cost (LAC)

b. Marginal Revenue = Long Run Marginal Cost = Short run Marginal Cost

c. Price > LAC

Monopoly regulation

a. Price regulation:- 1. MC Pricing (Price is charged equivalent to the MC)

2. AC Pricing (Price is charged equivalent to AC)

b. Taxes: Specific Tax (It will affect both MC and AC. If specific tax increases, price

increases and entire burden fallson the consumers. It is not a good way

to regulate a monopoly. )

Lump Sum Tax(It only affects on AC. Only profits would be reduced and

there is no change in quantity and price)

Price Discrimination: Price discrimination is an act of charging different prices from different

consumers for the same good.

Degrees of price discrimination

1. First Degree of Price Discrimination: Marginal Revenue curve also becomes the

demand curve, Marginal Revenue = Price, Each consumer is charged his respective reservation

price, It is also the ‘Take it or leave it’ strategy.

2. Second Degree of Price Discrimination: It is applicable to a particular section of

goods, Goods can be divided into different parts, Goods included are either recorded or billed or

metered.

3. Third Degree of Price Discrimination: • It is possible when the elasticities between

the two markets are different.

Inter temporal price discrimination

Separating customers with different demand functions into different groups which leads to

charging diff. prices at different points of time.

Peak load pricing:- Charge high prices at peak times because capacity constrain to cause MC to

be high

Two part tariff:- Consumers are charged both entry of usage fees.

Degree of Monopoly Power: The monopoly power determines the extent to which a monopolist

has control over either prices or quantities.

Measures of Monopoly Power:

1. Performance based: It is an outcome of the use of the monopolists’ ability.

❑ Elasticity of Demand: Monopoly power is the inverse of elasticity of demand.

MP= 1/Ed

❑ Lerner’s Measure: P − MC /P or P − MR/P or 1/Ed

❖ Greater the difference between price and marginal cost, greater will be the Lerner's

measure and thus greater will be the monopoly power.

❑ Cross Elasticity of demand: The measure was given by R.Triffin and thus it is also known as

Triffin’s Measure. Monopoly power is determined by how many substitutes does the good

has. More the number of substitutes, less will be the monopoly power. Therefore, monopoly

power is measured by taking the inverse of cross elasticity of demand.

Monopoly Power = 1 /ec

❑ Bain’s rate of return: P − LAC P

Higher the difference between price and average cost; higher will be the monopoly power.

2. Structural Based Measures:

❑ Concentration Ratio (CR): It measures the extent to which the large firms control the output.

❑ Hirfindahl-Hirschman Index (HHI) = ⅀x ^2

where x is the share of each firm.

xi = Xi / Total Industry size

❑ Gini Coefficient: It is a measure of inequality in a distribution and is measured with the help of

Lorenz curve.

Gini coefficient = 1 (In case of Monopoly)

= 0 (In case of Perfect Competition)

3. Monopolistic Competition:

Joan Robinson: "The Economics of Imperfect Competition"

E.H. Chamberlin: "The Theory of Monopolistic Competition"

Features of monopolistic competition are:

a. Large number of buyers and sellers b. Non-price competition c. Selling cost

d. Some influence over the price e. Non-price competition

f. Product variation

Perceived demand curve: It is subjective in nature. If one firm is changing prices, other firms

keep their price constant; it would cause a relative change in prices making the perceived demand

curve slide down.

Proportionate demand curve: If number of firms increase, the curve shifts leftwards implying

that the proportionate quantity demanded of that firm’s output decreases.

❑ In case of monopolistic competition, a firm can earn super normal profits or normal profits or

even losses in the short run; while in the long run it earns only normal profits.

The conditions of equilibrium are:

a. MC = MR

b. MC should be rising

Chamberlin explained the concept of Excess capacity in terms of perceived and

proportionate demand curve.

In the long run, the perceived demand curve shifts

down due to active price competition.

Excess Capacity: Extent to which the long run

output is falling short of ideal output is called

excess capacity. It must be noted that excess

capacity is a long run concept and is not applicable

in the short run.

❑ There is always an excess capacity in case of monopolistic competition due to downward

sloping demand curve. Greater the elasticity of demand curve, lesser will be the excess

capacity.

Causes of excess capacity

1) Downward sloping dd curve

2) Product differentiation

3) Entry of a very large no. of firms

Cassel’s View on excess capacity: According to him, excess capacity can be divided into two

parts: Firstly, Individual optimum, Secondly, Social Optimum.

Chamberlin’s View on excess capacity: According to him, excess capacity will arise when firstly,

there is free entry and secondly, when there is no price competition.

Price Output Equilibrium under Monopolistic Competition and Perfect Competition:

1) Price is greater than MC under Monopolistic Competition.

2) Long run equilibrium under Monopolistic Competition is established at less than technically

efficient scale.

No profits or normal profits by both Monopolistic Competition and Perfect Competition.

Moreover, output is less in monopolistic competition as compared to perfect competition.

3) Price under Monopolistic Competition is greater than competitive price.

Monopolistic Competition & Economic Efficiency.

Economic inefficiency is caused by two factors:

1. P > MC: Value to > MC of \ producing customers

2. Excess capacity

1. A firm operating in a perfect market maximizes its profit by adjusting

a. its output price until it exceeds average total cost as much as possible.

b. its output price until it exceeds marginal cost as much as possible.

c. its output until its marginal cost equals output price.

d. its output until its average total cost is minimized.

2. In the short run, no firm operates with a loss, unless

a. variable cost equals fixed cost.

b. variable cost falls short of fixed cost.

c. total revenue covers variable costs.

d. total revenue covers fixed cost.

3. In perfect competition, when economic profits exist in the short run, they are very tenuous

because

a. costs will inevitably increase and eliminate profit.

b. price will fall because market supply will increase.

c. firms are driven to increase output in the short run to the point where average total cost will

equal price.

d. firms are driven in the short run to reduce output until average total cost equals price.

4. If a firm is producing where its SMC = price and the LMC is less that LAC, then it would do

better in the long run by

a. increasing output with its existing plant until LMC equals price.

b. increasing plant size until LMC and SMC are identical and equal to price.

c. decreasing plant size until LAC, SAC, and price are equal.

d. doing nothing because it is already at the long-run profit maximizing point.

5. In the long run, a profit-maximizing monopoly produces an output volume that

a. equates long-run marginal cost with marginal revenue.

b. equates long-run average total cost with average revenue.

c. assures permanent positive profit.

d. is correctly described by both (a) and (c).

Suppose that an excise tax is imposed on the monopolist’s product. If the monopolist’s marginal

cost is

6. horizontal in the relevant range, which of the following statements must be true?

a. The price will increase by an amount less than the tax.

b. The price will increase by an amount equal to the tax.

c. The price will increase by an amount greater than the tax.

d. An excise tax will have no effect on the price-output decision of a monopolist.

7. Since entry is barred in a monopoly, in the long run the monopolist will

a. do nothing since entry will not force an adjustment.

b. adjust output but leave the price at the short run profit maximizing level.

c. adjust price but leave the output at the short run profit maximizing level.

d. adjust both price and output levels to reflect long run scale of plant adjustments.

8. A monopolistically competitive market is characterized by all of the following except

a. easy entry.

b. differentiated products.

c. excess capacity.

d. economic profit in the long run.

9. A monopolistically competitive firm differs from a perfectly competitive firm in that, unlike the

perfectly

competitive firm, it

a. faces a downward sloping demand curve.

b. can change the characteristics of its product.

c. can vary the price of its product.

d. tends to operate with excess capacity.

e. all of the above.

Answers:-

1) C 2) C 3) B 4) B 5) A 6) A 7)D 8)D 9)E

Oligopoly:

Pure oligopoly (Without product differentiation; Homogenous)

Differentiated Oligopoly (With product differentiation; close substitutes)

Features of Oligopoly are:

a. Few Sellers b. Same good/different goods c. Interdependence

d. Selling costs e. Group behaviour f. Indeterminate demand curve

Causes for existence of oligopolies.

1) Economies of scale :- When economies of scale are strong, Market may be too small to

support large no. of firms.

2) Barriers to entry:- It include both Technological and legal barriers to entry

3) Product Differentiation: This gives the firms some kind of Market Power

4) Firm-created causes of oligopolies

a) Merging

b) Predatory Pricing :- Lowering the price so much to drive the rivals out of the market.

Collusive Oligopoly: Firms recognized that they can help each other in the form of:

a. Cartel: Group of firms mutually decide price and quantity and get rid of the uncertainty.

Types of cartel:

Perfect Cartel (Members cannot cheat. One firm out of the group decides the price and output

for all. The cartel acts as a multi-plant monopolist. It is a tight cartel because one firm has all the

control. The objective is joint profit maximisation.

Market sharing cartel (These are loose cartels which share the market)

Price leadership: Under this, one firm will set its price which will be followed by other

firms.

Low cost firm (Set a low price which is to be followed by high cost firms)

Dominant price leadership (Firm with maximum market share leads)

Barometric Price leadership (Firm which is oldest and most experienced)

Exploitative or Aggressive Price Leadership: (Large or dominant firm follows aggressive price

policies, threatens other firms)

Non-collusive oligopoly

Nash Equilibrium, given by John Nash 1951. It implies a set of strategies or action in which each

firm does the best it can, given its competitors.

a. Cournot Model: The model was developed in 1838 by Augustin Cournot.

Assumptions are:

• There are two firms.

• Firms produce homogenous goods.

• Firm assumes that other firm will keep its output constant.

• Marginal cost of producing a good is zero.

• The firms simultaneously take the decision.

The output produced by other firm is the ½ of the remainder. In the end, both firms produce

1/3rd of the total output.

If there are more than two firms, then total output produced in the market would be n/(n+1)

where n is the number of firms in the market. Suppose there are 10 firms, then total output

produced would be 10/11 of the perfectly competitive output and each firm will produce 1/11 of

the output.

• Cournot price is between monopoly price and competitive price. Mp > Cp > P.C.p

• Cournot price is the 2/3rd of the most profitable price.

• Cournot output is the 2/3rd of the maximum output or perfectly competitive output.

b. Bertrand Model: The model was developed in 1883.

• It works on the assumption that other firm will keep the price constant.

• Firms have an unlimited productive capacity to meet the demand requirements.

• The model is based on the price cutting behaviour.

• By under-cutting the price, the firm can capture the entire output.

• Concluding result of the model is:

Price = Average cost

Say there are two firms A and B, so the total output produced will be a perfectly competitive

output.

QA + QB = Perfectly competitive output.

c. Edgeworth Model: It is simply the modification of the Bertrand Model.

• Under this model, the firms do not have unlimited capacity.

• We do not get any determinate solution.

• Both firms share the market equally.

❑ The firms under cut the price and reach

perfectly competitive price (p’). Later the

firms then start increasing the price and

reach monopoly price (p). As a result, the

price keeps oscillating between monopoly

and perfectly competitive price.

Stackelberg Model

• It is also known as the First Mover Advantage Model.

• It is a development over Cournot model.

• The firms move in a sequential way.

• Reaction Curves: It is the locus of maximum points of output of a firm given the reaction by

other firms.

• Iso-Profit Curve: Locus of points of same profits. Under this, price leadership as well.

• First entrant will know the reaction of other and will move accordingly. Same is the case with the

other.

Kinked Demand Curve

The concept of kinked demand curve was given

by Sweezy in 1939. According to this, if a firm

raises its price, then the price rise is not matched

by other firms. If a firm reduces its price, then other

firms will also reduce its price. The kink arises in

the demand curve due to the difference in elasticities.

Concepts in Kinked Demand Curve are:

• Prices and Quantity are rigid at the kink.

• Decline in costs, keep the prices stable but the gap in elasticities increase. As a result, the

break in MR curve increases.

• Decline in demand keeps the prices stable.

• Increase in costs and increase in demand leads to the rise in prices. Also the gap between

the elasticities reduce as a result of which the break in MR reduces leading to the rise in

prices.

Chamberlin Model

• There are two firms. • The firms produce homogenous goods.

• One firm will recognize the interdependence and will predict the action of other firm and

set its output.

• The concluding result is that each firm acts as a monopoly and hence ½ of the output is

produced.

Hall And Hitch Average Cost Pricing

• Also known as Full Cost Pricing, Mark Up Rule.

• Price = Average Direct Cost + Average Indirect Cost + Margin for profit.

• They used kinked demand curve and stated that mark-up is inflexible making the prices rigid.

• Average cost is used by the firms when; Firstly, Price > Average cost, which threatens the

position of firms due to possibility of more firms entering the marker. Secondly, If MR and MC are

unknown then average cost pricing is beneficial. Lastly, it is considered to be morally correct

because it charges the lowest possible price.

Andrew’s Version of Average Cost Pricing

• Price = Average Direct Cost + Cost Margin. Cost margin should cover indirect cost with

some level of profits.

• Cost Margin = (Indirect Cost + Normal Rate of Profit)/Q and remains constant due to

following two reasons: Firstly Andrew assumes a saucer shaped long run average cost

curve. Secondly, price set is relatively flexible due to changes in direct and indirect cost.

Limit Price

• The concept of Limit Price is given by Bains, Sylos, Labini.

Bains Limit Price: It considers the entry of potential firms. Limit price is the price set which

does not allow firms to enter the market.

E = PL − PC / PC

Where:

E = Condition of Entry, PL = Limit Price, PC = Competitive Price

Sylos Labini Limit Price: They gave Sylos Postulate which analyzed the expected behaviour of

established firms and potential entry.

❑ Already established firms will feel that new firms will not enter if price is less than average

cost for the latter. While new firms believe that when they enter the market, the price would

become greater than average cost.

Factor Pricing

Factor prices depends on the services rendered by factors.

Derived demand

→ Factors don’t directly satisfy consumer wants; but indirectly by producing goods & services.

Features of derived demand are:

1) Indirect demand 2) Produce goods & services 3) Derived from demand of Goods & Services.

Marginal productivity :- ‘Additional product’ due to employment of an additional unit of a

factor.

Marginal Physical Productivity or Marginal Product: TPn – TP n-1, TP

Marginal Revenue Productivity (Addition to total revenue): TRP/ L MRP = MP x MR

Value of Marginal Productivity: VMP = MP x AR

Under Perfect Competition, MR = AR, VMP = MRP

Other than Perfect Competition, AR > MR, VMP > MRP

Cost of the factor

Average Factor cost AFC = TFC/units of factor used

AFC = Total Wage Bill/no of labour emp.

Marginal Factor Cost (MFC): Difference in total wage bill when additional labour is emp.

MFC = TFCn – TFCn-1

Theory of factor pricing → Marginal productivity theory

→ Modern theory

Marginal Productivity Theory

Propounded by T.H. Von Thunen in 1826.

Later given by Ricardo, Clark, Marshall, Karl Menger, Bohn Baverk, Warlras, Wicksteed, Edgeworth.

Under Perfect Competition, price of the service of factors is equal to MP.

Demand for a factor → MRP curve (in a competition mkt)

Equilibrium: MRP = w

If MRP > w, hire more labour

If MRP < w; lay off labour

Theory by Clark → Focused on supply Side & ignored the demand side.

Theory by Marshall → Considered both supply and demand in determining the wages & labour.

Supply Curve of Labour: Backward bending:- At higher wages, workers prefer desire to work

Substitution effect → Always positive in case of labour supply

Increase in in wage → Induce workers to work more → Substitute leisure

hours for work hours

Income effect: Rise in wage →Prefer Leisure → Discourages Work

❑ Till the point supply of labour curve is upward sloping, then S.E. > I.E.

❑ When the supply of labour curve bends backward, I.E. > S.E.

Perfect competition in product & factor market

In the short run, Factor market & product market

may be earning losses/profits.

Long run:- MRPL/W = MRPL/r

This equation shows variability of factor

❑ With decrease in wages → MRPL curve shifts leftwards

Monopolistic exploitation” given by Joan Robinson

Under this, the exploitation will

take place to the extent of RE.

RE level of exploitation is known

as Monopolistic Exploitation.

❑ Under monopsony in the factor market, the

labour faces monopsonistic exploitation. If

the factor market would have been perfectly

competitive, then the labour would have got

wages to the extent of Wpc. However, in this

case he gets wages Wm.

In case of Monopoly, there is double exploitation.

The exploitation doubles in the sense that labour

generates marginal revenue to the extent of WU

but receives wages Wm. Hence he faces

Monopolistic as well as monopsonistic

exploitation in this case.

Labour is doubly exploited because:-

1) Excess of MRP over price of factor → Monopsonist Exploitation

2) Due to excess of VMP over MRP → Monopolistic Exploitation.

Adding up Problem: Product Exhaustion Theorem

→ Each factor paid according to its M.P. As a result, total output would

be exhausted without out any surplus

Wicksteed’s solution of product exhaustion problem: Phillip Wicksteed.

Used Euler’s Theorem X = MPL.L + MPK.K

Economic Rent :

Amount that firms are willing to pay for an

Input less the minimum amount necessary to

buy it.

THEORIES OF DISTRIBUTION

1. Ricardian Theory:

Ricardo uses a marginal principle and surplus

principle. The land gets rent, labour gets wages

and entrepreneur gets profit. According to him,

land is the most important factor of production

and as a result rent should be paid first.

The remainder of the income would then be

divided into wages and profits.

2. Marxian Theory:

He considered two classes: a. Capitalists: Who exploited labour on the basis of surplus value.

b. Workers

❑ Capital accumulation reduces the rate of profit because capitalists’ source of profit is labour.

So if labour is equipped with capital, then less profit would be left for capitalists.

Constant capital (C)+ Variable Capital (V) + Surplus Value (S)

Degree of exploitation = S/V

Organic Composition of Capital = C/V

Rate of Profit = S/(C+V) or (S/V) ÷ 1+(C/V)

If rate of profit is to be increased, then following measures should be taken;

a. Prolonged working hours of labour.

b. Reduce the time of labour used by him to produce for his own subsistence.

c. Capital Accumulation: According to Marx, capitalists will opt for capital accumulation.

3. Kalecki’s Degree of Monopoly:

According to him, there are two classes: a. One who gets economic profit

b. One who earns wages

❑ Kalecki used Lerner’s Measure to identify the monopoly power, that is;

Monopoly Power = (P-MC)/P

QUESTIONS FOR CLARIFICATION

1. In the labor market, if the government imposes a minimum wage that is below the equilibrium

wage, then

(a) workers who wish to work at the minimum wage will have a difficult time finding jobs.

(b) firms will hire fewer workers than without the minimum wage law.

(c) some workers may lose their jobs as a result.

(d) nothing will happen to the wage rate or employment.

2. For a given positively sloped supply curve, the price increase to consumers resulting from a

specific tax imposed on sellers will be

(a) greater the more price elastic demand is.

(b) greater the less price elastic demand is.

(c) equal to the entire tax when demand is perfectly elastic.

(d) equal to half of the tax whenever demand is unit elastic.

3. In defining a long-run average cost curve,

A) factor prices are varied and the quantity of factors of production is held constant.

B) factor prices are held constant and technology is assumed to change.

C) the time period must be longer than one year.

D) factor prices are held constant and the quantity of factors of production used is varied.

4. A firm's decision about whether to shut down or continue production would not include in its

consideration ______

A) fixed costs.

B) accounting costs.

C) economic costs.

D) implicit costs.

5. If the price elasticity of demand is 0.5, then a 10 percent increase in price results in a

A) 5 percent decrease in total revenues.

B) 0.5 percent decrease in quantity demanded.

C) 5 percent decrease in quantity demanded.

D) 5 percent increase in quantity demanded.

Answers:-

1) D 2) B 3)D 4)A5)C

GENERAL EQUILIBRIUM AND WELFARE ECONOMICS

Partial Equilibrium: It doesn’t consider the interdependence between the two markets, that is,

factor market and product market.

General Equilibrium: Under general equilibrium, interdependence is considered.

General Equilibrium involves following conditions:

1) Efficiency in exchange

Exchange economy:- Market in which two or more consumers trade two goods among

themselves. Efficient Allocation (Pareto Efficient) :- Allocation of goods in which no one can be

made better off unless someone else is made worse off.

Efficiency in exchange is attained when:- MRSxyA = MRSxyB

2) Efficiency in Production

Technical efficiency:- when firms combine to produce a given output as inexpensively as

possible. Production contract curve :- Shows all technically efficient combination of inputs.

Efficiency in production is attained when :- MRTSLXM = MRTLKN

3) Efficiency in Product - Output Mix

Production Possibility Frontier (PPF) or (PPC): Shows combination of 2 goods that can be

produced using fixed quantities of inputs.

Slope of PPF → Marginal rate of transformation (MRT)

Amount of one good that must be given up to produce one additional unit of the second good.

MRT = MCA/MCB

MRT is increasing; because as we shift resources from B to A, their MP increases in case of inputs

producing B where MP decreases in case of inputs producing A.

Output efficiency will be attained when :- MRTxy = MRSxyA = MRSxyB

For maximisation of welfare :-

1) National Income :- if National Income increases → welfare increases Given that tastes remain

constant

2) Distribution of National Income :- Income transferred from rich to poor → welfare increases

Features of Old Welfare Economics:

• It was given by Classicals (Pigou, Bentham, Marshall).

• Analysis was cardinal.

• Welfare is subjective, depending on the state of mind.

• Welfare is measured in terms of individual’s level of satisfaction measured in terms of money.

Social welfare is the sum total of individual welfare.

• National Income was used as a measure of social welfare.

Pareto Optimality:

Assumptions: a. Factor prices are known.

b. Technology is given.

c. Prices are given.

d. Consumers and producers are rational.

❑ Pareto optimality is a point where someone can only be made better off by making someone

worse off.

❑ It is an ordinal measure of utility.

❑ It is free from value judgement.

❑ Concept of pareto optimality is free from

comparison.

❑ The locus of point of tangency of the indifference

curve is known as contract curve. At this curve,

MRSXYA = MRSXYB

❑ Pareto Optimality will always lie on the contract curve,

which implies that there are no leftovers. However,

there is no unique solution on the contract curve.

New Welfare Economics (Kaldor-Hicks)

Under this, someone is made better off and someone is made worse-off. Welfare is dependent on

production and the distribution side is ignored.

Assumptions:

a. Technology is given. b. No externalities. c. Ordinal utility.

d. Satisfaction derived by different persons are independent of each other.

Compensation Criteria:

Kaldor’s view: Kaldor gave his view from the gainer’s point of view. If gainers can compensate

losers and still they are better off, then social welfare increases.

Hicks’ view: Hicks gave his view from the loser’s point of view. If losers cannot convince the

gainers to make the change, then the optimality is achieved.

Utility Possibility Frontier: It was given by Samuelson.

Scivotsky Criteria:

Scivotsky gave a double criteria of welfare which includes two tests which should be satisfied to

get consistent results:

1. Kaldor-Hicks: If movement is to a better point than before, Kaldor-Hicks criteria is satisfied.

2. Reversal tests: A reverse Movement should not possible.

Grand Utility Possibility Frontier (GUPF)

Above point shows us the locus of pareto

optimal points, that is, the grand utility possibility

frontier. At all points on this curve,

MRSXYA = MRSXYB = MRT

Social Welfare Function is the ordinal index of

society’s welfare. Abram Bergson introduced

the concept of social welfare function in 1938.

Social Welfare Function

Classical’s Social Welfare Function: • Cardinal in nature

• Societal welfare is dependent upon all individuals in the society.

• Equality in distribution of income which leads to the formation of social welfare function.

Rawlsian’s Social Welfare Function: According to this, the social welfare sees the degree of

inequality. For welfare to take place, the worst off person should be made better-off.

Bergson-Samuelson Social Welfare function:

• It considers ordinal utilities • Society welfare is dependent upon ordinal utility.

• Inter-personal comparison. • Value judgements should be consistent.

Arrow’s Impossibility Theorem/Arrow’s Theory of Social Choices

The theory states that it is impossible to construct a social welfare function that will reflect

individual’s preferences. Social choices made will not be able to reflect individual choices.

BAUMOL’S SALES MAXIMISATION MODEL

The main aim of the model is to maximize the sales or maximizing revenue from sales, subject to

some minimum level of profits.

❑ The managers aim to maximize revenues instead of maximizing the profits. As a result, the firm

does not operate at profit maximizing level of output. Rather it works at output level where the

sales is maximized, so as to maximize revenue. If the firm produced more than this level, then

profits would become less than the minimum profit level, hence causing disequilibrium to the

shareholders. Therefore, the management prefers to produce output till the maximization of

sales.

❑ It should be noted that profit maximization leads to lesser output as compared to revenue

maximization.

MARRIS MODEL OF MAXIMISATION OF GROWTH RATE

According to R. Marris, the managers do not aim to maximize profits. Rather they aim to maximize

the balanced growth rate of the firm. It can be expressed as

Maximise: G = Gd = Gc

Where: Gd is the growth of product market, Gc is the growth of supply of capital.

It should be noted that utility of managers is a function of,

U managers = F ( Gd, Job Security)

And Utility of owners is a function of

U owner = F( Gc)

❑ Marris also talked about two types of constraints

1. Managerial constraints: These are related to the skills of manager and research &

Development.

2. Financial constraints: Financial Constraint is a combination of debt ratio, liquidity ratio and

retention ratio.

a. Debt Ratio/Leverage ratio = 𝑫𝒆𝒃𝒕 / 𝑮𝒓𝒐𝒔𝒔 𝒗𝒂𝒍𝒖𝒆 𝒐𝒇 𝒂𝒔𝒔𝒆𝒕𝒔

(Higher the ratio, lesser the security)

b. Liquidity Ratio = 𝑳𝒊𝒒𝒖𝒊𝒅 𝒂𝒔𝒔𝒆𝒕𝒔 / 𝑻𝒐𝒕𝒂𝒍 𝒂𝒔𝒔𝒆𝒕𝒔

(Higher the ratio, higher is the security)

c. Retention Ratio = 𝒓𝒆𝒕𝒂𝒊𝒏𝒆𝒅 𝒑𝒓𝒐𝒇𝒊𝒕𝒔 / 𝑻𝒐𝒕𝒂𝒍 𝒂𝒔𝒔𝒆𝒕𝒔

(Higher the ratio, higher the security)

Instrument variables in Marris model are

1. Financial security coefficient Policies adopted by managers. i.e., 3 ratios

2. Rate of diversification

3. Average profit margin → Higher the expenditure on (A) & (R & D), Lower the profit.

❑ According to Marris, the managers try to maximize their own utility function because owners

get highly satisfied with the size of the firm and growth rate of the firm. Thus, managers try to

maximize a steady growth rate.

WILLIAMSON’S MANAGERIAL THEORY

The theory was given by O.E. Williamson. He stated that the managers are motivated towards

their own self-interest and they try to maximize their own utility function.

The utility function of managers is as follows:

U managers = F( Monetary expenses, number of staff under the manager, management

slack, discretionary investment)

Managerial utility function :-

1) Salaries & other forms of monetary compensation

2) Number of staff under the control of a manager: More the staff →More the power →

Greater the utility

3) Management Slack → Lavishly Furnished offices, cars, etc.

4) Magnitude of discretionary investment expenditure made by managers: Amount of

resources which managers can spend according to their discretion

Actual profits = Revenue (R) – Cost (C) – staff expenditure (S)

Reported profits = R – C – S – management slack

THEORIES OF DISTRIBUTION

Theories of Rent

1) Ricardian theory of rent.

Book “Principle of Political Economy & Taxation”

- Rent arises due to operation of law of diminishing returns

2) Modern Theory of Rent

Given by Pareto, Joan Robinson, Boulding

- Rent is determined by forces of Supply & demand.

Acc. To modern theory, Rent = difference between actual earning of a factor over its transfer

earnings.

Rent depends on elasticity of supply of factors of production:-

1. Perfectly elastic supply :- no economic rent.

2. Totally inelastic supply :- entire income is economic rent no transfer earning.

3. Less than perfectly elastic supply: Income will be distributed among economic rent and

transfer earnings

Wages

1. Subsistence theory of wages

In the Long Run, wages = Min. level of subsistence sufficient enough to meet the basic

necessities of life

Wages > subsistence level → Labour will marry early → More children →Rise in workforce

→Moneys wages will fall

2. Wage Fund Theory

Introduced by Adam Smith; developed by J.S. Mill

Wage Rate = Wage fund/No of Workers → Part of Floating capital

Increase in wage rate can be achieved in 2 ways :-

a) Increase in floating capital

b) Decrease in number of workers

3. Residual Claimant Theory

Given by Walker

Wages = TP – (Rent- Interest- Profit)

Leftover is distributed as wages

4. Marginal Productivity theory of wages

Under Perfect Competition:

Wages = MP

If MP > wages; firm will employ more labour

If MP < wages; firm will lay off workers

Prof Taussing :- wages are not equal to MP but W = Discounted Marginal net product

which accounts for risks like fall in price of product in future

THEORIES OF PROFIT

1) Hawley’s Risk bearing theory of Interest (F.B. Hawley)

Profit :- Reward for taking risks; higher the risk, higher should be the profit.

2) Uncertainty theory of profit: By Knight

Profit :- Reward for uncertainty bearing & not risk taking.

Risk is anticipated and be insured, and uncertainty is Unforeseen & are non-is insurable

uncertainty.

Rent Theory of profit: By Francis A Walker

Features of profit : a) Profit is rental in character;

b) profit of superior businessman is calculated from less efficient ones.

COBWEB THROREM

❑ An economic model that explains why prices might be subject to periodic fluctuations in

certain types of market.

❑ It describes cyclical supply and demand in a market where the amount produced must be

chosen before prices are observed

Possibilities :- (1) Perpetual oscillations

(2) damped oscillations

(3) Explosive Oscillations

1. Perpetual Oscillations:-

Slope of demand curve = slope of supply curve

2. Explosive Oscillations:

Slope of demand curve > slope of supply curve

3. Damped Oscillations :-

Slope of Demand curve < slope of supply curve

ASYMMETRIC INFORMATION

❑ The model of perfect competition is based on the assumption of perfect information. But in

reality, no economic participant can have full, efficient, and perfect information. This means

that consumers and producers make decisions under uncertainty.

❑ Imperfect information means the absence of certain knowledge about the probability of an

outcome

❑ Information asymmetric when one of the participant has a better information than others. This

idea of asymmetric information is the core of Economics of Information

Market for Lemons: Akerlof

❑ Here, Lemons were referred to the second hand market where used items were sold. When

product quality is unobservable by buyers, sellers will lower product quality. Buyers will expect

sellers to skimp on quality and they lower their willingness to pay. Then prices will decline, and

in turn sellers will be forced to lower quality even further to make profits at the lower price.

Thus the quality will decline until nothing but the lowest quality lemons are left. Thus the

market fails. Sellers cannot sell high quality goods at high prices even though buyers would be

willing to pay the high prices for the high quality goods.

Moral Hazard:

Asymmetric information will attribute to the problem of moral hazard.

This is the lack of incentive to guard against risk where one is protected from its consequences.

Example: Comprehensive insurance policies decrease the incentive to take care of your

possessions.

The risk of moral hazard could possibly be eliminated by methods like Coinsurance, Co-

payments, and Deductibles.

Adverse Selection:

Due to asymmetric information, Insurance market also faces the problem of adverse selection

In the case of insurance, adverse selection is the tendency of those in dangerous jobs or high risk

lifestyles to purchase products like insurance.

To fight adverse selection, insurance companies reduce exposure to large claims by limiting

coverage or raising premiums.

Market Signaling:

To avoid problems associated with the lack of information on one side.

This is the process of sellers using signals to convey information to buyers about the quality of

the product which helps the buyers and sellers deal with the asymmetric information.

In the insurance market, the buyers will give a proper knowledge regarding their health status to

the insurance companies to avoid the problems associated with the Information asymmetry.

Principal Agent Problem:

This arises when one party(agent) agrees to work in favour of another party(principal) in return for

some incentives.

This may lead to the problem of moral hazard and conflict of interest between the principal and

agent.

For eg: Principal(Stakeholder):Aims to maximize profits

Agent (Managers): Aims to increase the sales and revenues, so that they can

earn more incentives

QUESTIONS FOR CLARIFICATION

1. ---------------effect is an example of a network externality in which a consumer

wishes to own an exclusive or unique good

A) Bandwagon B) Snob

C) Veblen D) None of the above

2. The implication of asymmetric information about product quality was first

analysed by

A) Kenneth Lehn B) Michael Spence

C) George Akerlof D) Harvey Leibenstein

3. Which of the following has the lowest elasticity of supply?

A) Luxury items B) Necessities

C) Perishable goods D) None of the above

4. For complimentary goods, the cross elasticity of demand will be

A) Zero B) Infinity

C) Positive but less than infinity D) Negative

5. A firm will break even when

A) TR=TC B) MR=MC

C) AR=AC D) P=MC

6. In which of the following models of oligopoly it is assumed that firms believe

their rivals will continue to produce the same output irrespective of the output

produced by the firm

A) Kinked demand curve model B) Cournot’s

C) Price leadership D) Cartel formation

7. Which of the following does not indicate Lerner index of monopoly power?

A) L=P-MC/P B) L=P-MR/P

C) L=e/1 D) L=1/e

8. Monopolistic exploitation of labour occurs when

A) Wages equals Marginal Revenue Product

B) Wages are greater than Marginal Revenue Product

C) Wages equals Value of Marginal Product

D) Wages are less than Marginal Revenue Product

9. According to Karl Marx, organic composition of capital is

A) C+V B) C/(C+V)

C) S/ (C+V) D) S/V

The difference between positive economics and normative economics is

A) Positive economics describes the positive effects of economic decisions while normative

economics describes both positive and normative effects of economic decision

B) Positive economics describes the facts of an economy while normative economics prescribes

solutions

C) Positive economics describes demand and supply theories of individual markets and firms

while normative economics describes the total world economy as a whole

D) Normative economics describes demand and supply theories of individual markets and firms

while positive economics describes the world markets

Answers:-

1)B 2)C 3)C 4)D 5)C 6)B 7)C 8)D 9)A 10)B