UGC NET MACRO ECONOMICS MATERIAL

DETERMINATION OF OUTPUT AND EMPLOYMENT

1. Classicals: The terms ‘Classicals’ was coined by Karl Marx. According to them, the economy

will always be in a state of full employment, and any deviations from the equilibrium would be

restored automatically through market mechanism.

assumptions of the classical theory :-

1. Full Employment – All resources (L,K) are fully employed. No Government interference.

Classicals stated that there can be frictional and voluntary unemployment

in the state of full employment situation.

2. Economy is always, in the state of equilibrium

3. Laissez - faire system (Necessary Condition)

Laissez faire economy :– 1) Absence of Government Control

2) Absence of Monopolies and restrictive trade practices

3) Freedom of Choice – Consumers and Producers

4) Market forces of demand & supply operate

4. Money does not matter / Money is neutral

According to classicals, Money acts as a Medium of exchange

Level of output & employment = f (real resources in the economy, i.e., L,K)

5. Perfect Competition (No monopolies)

6. Closed economy (no trade)

7. Workers don’t suffer from money illusion, that is, workers easily determine price levels in the

economy and hence demand real wages.

8. Existence of 2 sectors - Real and Monetary (Classical Dichotomy)

9. Prices, wages are flexible in both upward and downward duration.

10. Rate of interest = f ( Savings(+), Investment(-))

11. Quantity Theory is used to determine price

12. Demand & Supply of labour = f (w/P) where w – nominal wages; P Price Level). This implies

there is No money illusion

❑ Say’s law was the basis of Classical Theory saying that supply creates its own demand.

In barter system, Goods produced by people → Some of it used for own consumption

→other part/surplus is used to purchase other goods →No overproduction

In the exchange economy, Prodn of Goods and services → employment of factors of

production → Generates Income in the form of factor prices →spending the Income

means generating demand for Goods and services

Therefore, AD=AS, and S = I, implying No surplus / deficit

According to Classicals, 𝐐 = 𝐟(𝐋, 𝐊̅, 𝐓̅)

Where: Q = Output, L = Labour, K = Capital (constant), T = Technology (constant)

❑ Supply of labor curve (SL) is upward sloping because substitution effect is greater than

income effect.

According to the Classicals,

SL = f (W/P), that is. Supply of labour is a function

of real wages.

DL = f (W/P . MRPL), demand for labour is a function

of real wages and marginal revenue productivity

of labour.

Potential GDP is the amount of goods and services

produced, given the resources and state of technology

when the labour market is in equilibrium.

Classical Dichotomy

By the term classical dichotomy we mean that there exists two independent sectors in the

economy- real sector and monetary sector.

There is a complete independence of real variables from nominal variables.

This implies that the money is neutral in nature. It acts as a medium of exchange only.

❑ According to the classicals, in the long run aggregate supply is fixed. So any change in the

aggregate demand would only lead to a rise in price level and there won’t be any change in

income.

❑ Keynes criticised the theory by introducing the following process:

Wages Decrease →Income Decrease →Aggregate demand decreases →Under-employment

2. Keynesian Theory

According to Keynesian theory, full employment is not possible. There will always be

underemployment equilibrium in the economy.

Moreover, the workers suffer from money illusion because;

DL = f (W/P); demand for labour is a function of real wages

SL = f (W); supply of labour is a function of nominal wages, because workers

cannot estimate perfectly the effect of price levels on their monetary income.

❑ Classicals: Money is neutral and acts as a Medium of exchange.

Keynesians: Money is not neutral and acts as a Medium of exchange and store of value.

According to Keynes,

Wages are flexible upwards & rigid downwards because :-

1) Wage contracts

2) Trade Unions

3) Min. wage laws

4) Efficiency on the part of labour.

There is a positive relationship between wages & working hours.

Aggregate supply Function

Total supply of goods and services in an economy.

Y= f (K,N) - SR Production function where N = labour

N = f (effective demand)

Aggregate Demand function – 2 sector model.

AD = C+ I, where I is exogenously determined.

C=f (Y) = “Fundamental Psychological law” when income increases, consumption

increases but not as much as the increase in income.

Nonlinear consumption function:-

MPC → decreases with increase in income

(As income increases, people consume a decreasing proportion of the marginal income)

❑ According to Keynes, C= a+by where b = MPC

Equilibrium income or output:-

AD = AS

C+I = C+S

❑ Savings = f (Income) while Investment = f (MEC, r) where MEC is the marginal efficiency of

capital (negative relationship) and r is the rate of interest (negative relationship).

AS Price(ASP): it is the minimum price given to the labour. The AS Price curve shows a

relationship between receipts and full employment

AD Price(ADP): These are the expected earnings which an employer can get out of sale of

output.

Point where ADP is equal to ASP, is known as Effective demand.

❑ Under Keynesian model, investment is exogenously determined and is considered to be fixed

in the short run.

Under Keynesian model, investment is exogenously determined and is considered to be fixed in

the short run.

Inflationary gap: The amount by which income is more than the full employment level. In other

words, it is defined as the planned expenditure in excess of output available at

full employment.

Increase in government expenditure →Full employment of resources; resources

will not increase (Demand for Factor > Supply of Factor) →Increase in factor

prices →Inflationary pressures

Deflationary Gap: It is the amount by which income is less than the full employment level.

Keynes didn’t take into consideration the expectations on the part of the buyer.

3. New Classicals:

Adaptive Expectations/ Regressive Expectations:

The theory was given by Philip Cagan and Nerlove in 1956-57.

Other New Classicals were Lucas, Sargeant, Wallace, etc.

❑ Adaptive expectations: Under this, people believe that future is in continuation of the past.

As a result, changes due to government policies do not take place

rapidly. It is a backward working approach.

❑ Rational Expectations: The theory was given by John Muth in 1961. It is a forward looking

approach and people are considered to be rational. Any errors in

forecasting is random in nature.

❑ According to this theory, any new policy will be ineffective because it would be anticipated

before it is being introduced. This was known as policy ineffectiveness/irrelevant impotency

theory which was given by Lucas.

❑ Long run supply curve will shift if there is a change in the labor, capital or technology.

❑ Equilibrium will be established at the point where equality is reached between long run

supplies, short run supply and demand.

Even when there is an increase in aggregate

demand, the price increases, monetary wages

then decreases, and supply of labour then

decreases. As a result, aggregate supply curve

shifts and reaches the full employment level in

the long run. Thus, money is super neutral.

Any change would only increase the price level,

keeping the output same.

Lucas Critique (1976):

❑ Lucas criticized the macro econometric models because due to any policy changes, the models

remained invariant. He believed that the relations in the models should change with any kind

of policy change.

4. Supply Side Economics: Given by Arthur Laffer

Postulates of Supply side economics

1) Labour supply has a positive slope

2) I = f (r)

3) Interest rate is determined by the supply of savings & demand for Investment funds.

4) Advocate free enterprise capitalist system with minimum Government intervention.

Central theme of supply side Economics

1) Factor supply & technology determine medium – term Growth Rate of output.

2) Factor supply is determined by post tax return on saving, Investment & work effort.

3) Excessively high rate of taxation reduces tax – revenue, factor supply & prevents growth.

4) Tax cut is the most effective incentives for saving, I & work effort.

5) Excessive control & regulation of business discourages I & efficiency.

Factors responsible for the emergence of this school are:

1. Gulf war crisis in 1973: This was one of the major supply shocks. In gulf war crisis,

Supply decreased → Oil price increased →Cost increased →Prices increased overall

2. U.S. was an exporter of agricultural products.

3. Depreciation of dollars, which made imports expensive, increasing the cost of production and

hence supply decreased.

4. Vietnam War: Government funded more on war.

Policy prescription

1. Reduce taxes 2. Reduce budget deficit 3. privatisation and deregulation

4. Favoured free trade 5. favoured investment allowances 6. against unemployment allowances

7. against the trade union activities

New Keynesians: The term “New Keynesians” was coined by Parkin and Bade in 1982.

The main aim of this school of thought was to improve upon the Keynesian theory. Keynes theory

did not provide any rationale for the wage-price rigidity.

Therefore, their main aim was:

1. Provide a rationale behind wage-price rigidity.

2. Provide micro-foundations to macro theories.

Assumptions taken by New Keynesians were:

a. Involuntary unemployment is possible.

b. Imperfectly competitive market structures.

c. Considered both supply and demand shocks.

d. Considered asymmetric information and incomplete labour markets.

e. The New Keynesians have talked about nominal and real wage-price rigidity.

❑ Price would be set with a mark up. Markup Price 𝐏𝐢 = (𝐞 / 𝐞 − 𝟏) 𝐌𝐂

❑ Aggregate output will depend upon real money supply (M/P).

❑ Relative prices remain constant. So with increase in income, the profits reduce.

❑ Menu costs: costs ofmaking the price adjustment.

❑ Aggregate price externality: If one price decreases price, the income share of other firms will

also increase due to income externalities. But firms never consider such externalities and hence

do not decrease the price.

QUESTIONS FOR CLARIFICATION

1) If an individual who cannot find a job because his or her job skills have become obsolete this

is an example of

(a) frictional unemployment.

(b) structural unemployment.

(c) cyclical unemployment.

(d) seasonal unemployment.

2) Firms react to unplanned increases in inventories by

(a) reducing output.

(b) increasing output.

(c) increasing planned investment.

(d) increasing consumption.

3) If the quantity of money demanded is less than the quantity of money supplied, then the

interest rate will

(a) either increase or decrease, depending on the amount of excess demand.

(b) increase.

(c) decrease.

(d) not change.

4) Which of the following events will definitely lead to an increase in the equilibrium interest rate?

(a) a decrease in the level of output (real GDP)

(b) the purchase of government securities by the Bank of Canada

(c) an increase in the level of output (real GDP) and an increase in the money supply

(d) the sale of government securities by the Bank of Canada

5) The main cause of cyclical unemployment is that

(a) firms engage in race, gender and sex discrimination in their hiring practices.

(b) some individuals do not have marketable job skills.

(c) the level of overall economic activity fluctuates.

(d) workers often voluntarily quit a job to look for a better job.

6) The aggregate demand (AE) curve would shift down if

(a) government spending were increased.

(b) taxes were increased.

(c) the money supply were increased.

(d) the interest rate decreased.

7) As the economy nears full capacity, the short-run aggregate supply curve

(a) becomes flatter. (b) becomes steeper.

(c) shifts to the right. (d) shifts to the left.

8) If the economy is operating at potential GDP, an increase in the money supply will lead to

(a) stagflation. (b) structural inflation.

(c) demand-side inflation. (d) supply-side inflation.

9) An increase in the MPS will cause, other factors remaining constant:

(a) a parallel shift up in the AE-function and a parallel shift up in the L-function;

(b) a rotational shift up in the AE-function and a rotational shift up in the L-function;

(c) a parallel shift down in the AE-function and a rotational shift up in the L-function;

(d) a rotational shift down in the AE-function and a rotational shift up in the L-function;

(e) a rotational shift down in the AS-function and a rotational shift up in the L-function.

10) Assume that interest rates increase in the United States but do not change in Japan. Which of

the following statements is true?

A. The demand for Japanese yen will increase

B. The supply of Japanese yen will decrease

C. The American dollar will appreciate

D. American exports to Japan will increase while American imports from Japan will

Decrease

Answers:-

1)D 2)A 3)C 4)D 5)C 6)B 7)B 8)C 9)D 10)C

CONSUMPTION HYPOTHESIS

Absolute Income Hypothesis: The theory was given by Keynes in 1936. Also known as

“Fundamental Psychological Law”. He considered a short run consumption function which is linear

in nature.

C = a + bY

Where a = autonomous consumption, b = Marginal Propensity to consume (MPC)

Average Propensity to Consume (APC) = C/Y

Marginal Propensity to Consume (MPC) = ΔC/ΔY

According to Keynes, when income increases, consumption also increases but not in the same

proportion. Thus, he assumed that the relationship between consumption and income are non-

proportional and is reversible over time.

Main Features of his theory;

• MPC is constant.

• In short run, APC > MPC. Similarly, average propensity to save (APS) is less than marginal

propensity to save (MPS).

• When income increases, APC decreases.

• APC + APS = 1, MPC + MPS = 1, 0 < MPC < 1

• APC becomes equal to infinity when income is zero.

• Current level of consumption is a function of current and absolute level of income.

• MPC declines with increase in income.

• APC declines with increase in income

Factors on which consumption function depends are:

Subjective

1. Individual motives (which influence consumption).

2. Business motives (which influences liquidity, financial soundness of a firm).

Objective

Factors which shift the consumption function like rate of interest, windfall gains or losses, credit

policies, etc.

Long run consumption function was given by Kuznets.

It focuses on the proportionality between consumption and income.

The consumption function is expressed as: C = bY

Empirical evidence suggest that in the long run, the MPC becomes equal to APC and their value is

0.9.

This theory was criticised by stating that based more on introspection than on facts.

Relative Income Hypothesis: The theory was given by Duessenberry in 1949.

It is different from absolute income hypothesis in two respects:

a. In relative income hypothesis, the consumption also depends on relative income besides

absolute income.

b. According to relative income hypothesis, the relationship between consumption and income

are irreversible, unlike the case in absolute income.

❑ Duessenberry gave the concept of Demonstration effect:

Households with relatively lower income & living in the community of higher incomes;

spend more proportion of income than the households with high incomes.

❑ The theory was based on imitations, that is, consumption habits of the people will ve

influenced by people around them.

Relative income can also be expressed as: 𝐑𝐲 = 𝐲𝐭 / 𝐲𝐭−𝟏

Ry = 1 APC constant

Ry > 1 APC decreases

Ry < 1 APC increases

1. If income of all households increases, then consumption level of all households will also

increase at the same rate. •

2. 2. If a household remains at the same scale of relative income and its absolute income

increases, then the absolute consumption and savings will also increase but MPC and MPS

will remain constant.

3. If a household is on the same scale of relative income and income of other households

increases, then MPC will increase, keeping the income to be constant.

4. If a household moves up from a lower income group to a higher income group, then its MPC

decreases.

❑ Duesenberry also introduced the concept “Ratchet Effect”.

According to Ratchet Effect, If income increases, consumption increases keeping APC constant.

“If income decreases, consumption remains constant because of firstly, the

demonstration effect and secondly, a consumer or household gets accustomed to

the consumption standards”.

❑ Short run aggregate consumption function of the community is linear because (C/Y) ratio does

not change much due to demonstration effect even when income increases in the short run.

Also with the fall in income, the (C/Y) ratio will not decline that much.

Permanent Income Hypothesis:

The theory of permanent income hypothesis was given by Milton Friedman in 1957 in his work

“A Theory of Consumption Function”

According to the theory, the consumption is dependent upon permanent income.

Measured Income (Ym) Ym = Yp + Yt

Permanent Income (Yp) Transitory Income (Yt)

Measured Consumption (Cm) Cm = Cp + Ct

Permanent Consumption (Cp) Transitory Consumption (Ct)

❑ No covariance between permanent income and transitory income, that is, Cov (Yt , Yp ) = 0

❑ No covariance between permanent consumption and transitory consumption, that is,

Cov (Ct, Cp)= 0.

❑ No covariance between transitory income and transitory consumption, that is,

Cov (Yt , Ct ) = 0

❑ Permanent consumption is a function of permanent income.

Cp = k. Yp

Where: k = APC

k = f (r, H, T, U)

Where: r= rate of interest; H = Proportion of human to non-human wealth,

T = Tastes and preferences, U = variability (or changes in income).

❑ According to permanent income hypothesis, in long run APC is constant. However, in short

run, APC decreases with increase in income.

❑ Short Run MPC < Long Run MPC

Life Cycle Income Hypothesis:

❑ The theory was given by Ando, Modigliani in 1957 in their work “The Life Cycle Hypothesis

of Saving: Aggregate Implications and Tests”.

❑ According to the theory, an individual will base his consumption on the lifetime income

Consumption depends upon:

1. Resources available to the person 2. Rate of return on capital

3.Spending age 4. Age at which the plan will be made

❑ According to the theory, in long run, APC = MPC

and it supports Kuznets curve and cross sectional

non-proportional relationships.

❑ In short run, APC rich < APC poor

DEMAND FOR MONEY THEORIES

Classical Theory: Classical quantity theory of money was conceived by Jean Bodin in 1568.

Fisher’s Quantity Theory of Money: Given by Fisher in 1911 in his book “Purchasing Power of

Money”.

According to the theory, MV = PT

Where, M = Quantity of Money/ supply of money,

V = Velocity of money, P = Price Level, T = Transactions

❑ MV represents the supply of money and PT represents the demand for money.

❑ Demand for money will be dependent upon the value of transactions to be undertaken.

❑ Transaction demand, is a constant proportion of income and is a function of full employment.

Fisher expanded the equation:

Included money supply created by banks in their credit creation process.

MV + M1 V1 = PT

M1 = Total Bank deposits subject to transfer by cheques.

V1 = average Velocity of circulation of bank deposits.

❑ Any increase in money supply → increase in Price level.

Income Version of Quantity Theory of Money

The theory emerged because there is a difficulty in measuring the price level (P) and number of

transactions (T) in the case of Fisher’s quantity theory of money.

This theory states that; MV = PY

❑ The theory replaced velocity of circulation with income velocity, that is, number of time a unit

of money is used for making payments involving the final goods.

❑ Income version only considers final goods. Also demand for money is dependent on real

income or real output.

❑ Supply of money increase → Rise in cash balance with the people spending on Goods &

Services → AD increase, no change in AS (Production Cannot increase in SR) → Increase in

price

Cambridge Version/Neo-Classical/Cash Balance Approach:

The approach was initially given by Alfred Marshall and later modified by Pigou, Robertson,

Keynes.

According to them, price level is affected only by that part of the money which people hold in the

form of cash for transaction purpose, and not by total money supply, that is, MV which was

suggested by Classical theory.

According to the theory, Md = kPy

k = proportion of income held for transaction purposes

Robertson’s Equation for Demand for Money

M = P k T

Where, M = Quantity of money, P = Price level, k = proportion of total amount of goods and

services which people wish to hold in the form of cash balance, T = Total Volume

of G & S Purchased during a year.

Pigou’s Equation

P = KR/M

Where, P = Value of money, K = Prop. of total real resources or income (R) which people wish to

hold in the form of titles to legal tender units of legal tender, M = Number of actual units

of legal tender.

• k = 1/V, that is, k is the inverse of velocity of circulation of money.

• Money and prices are directly related to each other.

• Income elasticity (ey) and price elasticity (ep) is equal to one.

Keynesian Theory of Demand for Money

Keynes introduced three motives for Demand for Money:

1. Transactionary motive: Money is demanded for day to day transactions.

(Demand for money is a function of Income) Mt = f (Y)

2. Precautionary motive: Money is demanded for some unforeseen events

(Demand for money is a function of Income) Mp = f (Y)

3. Speculative Motive: Money is demanded for investment purposes

(Demand for money is a function of rate of interest) MS = f (r)

There is a negative relationship between demand for money and rate of interest because of the

following process:

Rate of interest increase → Bond prices decrease →Demand for money is low

❑ If the bond prices are high, a consumer would want to sell it. If bond prices are low, consumer

would want to buy the bonds

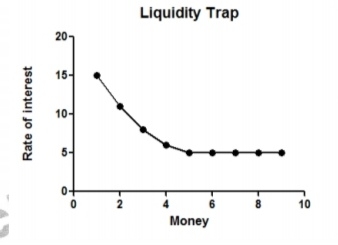

Liquidity Trap

Under the state of liquidity trap, the interest

rate is so low that the demand for money

becomes infinitely elastic. Moreover, the

supply of money will not affect the rate of

interest and income.

Baumol’s Inventory Theoretic Approach:

The theory was given in Baumol’s famous work “The Transaction Demand for Cash and

Inventory Theoretic Approach” in 1952.

Keynes → Mt,Mp, Msp Separately

Baumol → Together as Real cash Balance

Keynes → Demand for money = f (Y, i)

Baumol: Demand for money = f (Y, I, cost of transforming real cash balance into interest bearing

bonds)

Keynes → Mt is not a f (interest)

Baumol → Mt = f (interest).

❑ In short, in the theory given by Baumol, individuals hold money as a form of inventory

optimum cash holding. Opportunity cost of holding money is the interest income foregone.

❑ If interest rate on assets increase, then people readjust their portfolio by transferring money

towards those assets.

❑ Overall, individuals would hold money in the form in which their cost is minimum.

Costs of individual consist mainly of two; 1. Interest income foregone 2. Brokerage fee(b)

If b is very high, then the individual demands more money.

If r is high, then individual’s demand for money is less.

Friedman’s Restatement of Quantity Theory of Money:

The theory is based on the Cambridge’s quantity theory of money. It is also known as the

‘Modern Theory of Demand’ or ‘Capital Theoretic Approach’.

Friedman treats money as a capital good

Further, he stated that k is a function of:

a. rm (Rate of interest on income)

b. rb (Rate of interest on bonds)

c. re (Rate of interest on equities)

➢ Demand for money is the function of;

1. Rate of interest on income 2. Rate of interest on bonds 3. Rate of interest on equities

4. Wealth (W) 5. Proportion of Human to Non-Human Wealth (H)

6. Price Level (P) 7. Rate of Inflation Rate of interest

Tobin’s Theory of Interest Elasticity of Transaction Demand for cash:

❑ The theory was given in 1956. It is based on the Liquidity Preference Behavior towards risk. The

theory, unlike the previous ones, considers both risk and return.

❑ People want to maximise utility which is function of wealth and risk.

❑ Keynes: Individual held money either in the form cash or bond

Tobin: Individuals can hold both cash and bonds

Baumol-Tobin Theory:

❑ Baumol and Tobin together gave a theory for demand for money to prove that income

elasticity for demand for money is less than one; and change in demand for money is less than

the change in income

According to them, Bond Holding = f (Income, number of bond transactions)

Revenue = rate of interest * ABH (Average Bond Holding)

❑ When r increases, cash holdings decreases and people prefer to keep money in the banks, and

thus demand for money decreases.

❑ When Income increases, both bond holdings and cash holdings increase. However, increase in

cash holding is less than the increase in bond holdings. This implies that income elasticity of

demand for money is less than one.

❑ Empirically they calculated the values as:

Income elasticity for demand for money 0.5

Interest elasticity 0.5

QUESTIONS FOR CLARIFICATION

1. The word economy comes from the Greek word for

(a) environment.

(b) one who participates in a market.

(c) one who manages a household.

(d) conservation.

2. In the circular-flow diagram,

(a) firms are buyers in the product market.

(b) households are sellers in the resource market.

(c) firms are sellers in the resource market and the product market.

(d) spending on goods and services flow from firms to households.

3. An increase in the growth rate of the money supply is most likely to be followed by

a. a recession. b. inflation.

c. a decline in economic activity. d. all of the above.

4. Budget deficits can be a concern because they might

a. ultimately lead to lower inflation.

b. lead to lower interest rates.

c. lead to a higher rate of money growth which causes inflation.

d. cause all of the above to occur.

5. Which of the following are true statements?

a. Inflation is defined as a continual increase in the money supply.

b. Inflation is a condition of a continually rising price level.

c. The inflation rate is measured as the rate of change in the aggregate price level.

d. Only (b) and (c) of the above are true statements.

6. Assuming that the inflation rate is positive, which of the following statements characterizes the

relationship between the actual or observed interest rate and the real interest rate?

a. real interest rates are lower than actual interest rates

b. real interest rates are higher than actual interest rates

c. they are the same thing

d. none of the above is necessarily true

Answers:-

1)C 2)B 3)B 4)C 5)D 6)A

INVESTMENT THEORIES

❑ Financial Investments: Shares and bonds, etc. There is no addition or creation of capital

❑ Real Investment: It implies addition in capital stock

Fixed Invt.: Example, Machinery

Residential Invt.: Example, Housing

Inventory Invt.: Adding stock of capital

Keynes Theory of Investment

Keynes in his theory talks only about Real Investment.

Also, investment can either be autonomous (independent of level of income) or induced (function

of income). Therefore, Keynes gave the Investment function as follows:

I = f (MEC, r, business expectations)

MEC refers to the expected rate of return from investment over its cost.

Rate of Interest has a negative relation with that of investment.

There were two views about MEC;

❑ First view was given by Fischer who in 1963 stated that MEC is dependent on the profit

generated.

❑ Second view was given by Keynes who said that MEC is dependent on the expected return. It is

the rate of discount which would make prospective yield equal to its supply price, that is, which

makes return = cost.

According to Keynes, while considering MEC, rate of interest is relatively sticky.

Moreover, MEC declines with increase in investment because of two reasons:

a. Prospective yield with time decreases.

b. Supply price increases.

If MEC > r Investors will invest

If MEC < r Investors will not invest

So equilibrium is attained when MEC = r

Marginal Efficiency of Investment (MEI):

It reveals investments at different rates, given the optimal stock.

MEI curve shows the investment demand for the entire community at different rates of interest.

Accelerator Theory

❑ Clark gave the accelerator principle and this theory was propounded way before Keynes.

Before studying the accelerator theory, we need to understand the idea behind multiplier and

accelerator

Multiplier Change in investment leads to a change in income

Accelerator Change in income leads to a change in investment.

It/Δy = v = Accelerator

where, It: Level of Invt. ΔY: Changes in Income v: Accelerator

Acceleration theory of Investment describes a technological relationship between the change in

capital stock & the change in level of output.

Assumptions:

1. C-D production function 2. Factors of production are homogenous & perfectly divisible

3. Factor market is competitive & factor prices are given

4. Firms produce with least cost combination of inputs 5. No excess production capacity

6. Firms’ calculation about the future demand is fairly accurate

7. No financial constraint & funds are easily available

Fixed Accelerator Model: Assumptions of the model are:

• Accelerator (v) will be fixed

• No time lags in Investment decisions

• Instantaneous adjustment

• Excess capacity in Investment sector, that is, unutilized capital stock.

Flexible Accelerator Model:

It considers both optimal (desired) capital stock and Actual capital stock and there is a gap

between them.

Kt+1 – Kt = λ (K* - Kt)

Where: λ = speed of adjustment, K* = optimal capital stock

However, there is just partial fulfilment in the gap.

Moreover, λ is negatively affected by the rate of interest.

Investment are less volatile.

Capital Stock Adjustment:

• There are lags present. • Gap between optimal and actual is to be filled.

• Immediate adjustment would be more costly. • Per period addition is made.

Neo-Classical or Jorgenson’s theory of Investment:

The theory helps determine the desired level of capital that any firm would want to hold. The

theory used a Cobb-Douglous Production function.

Assumptions of the model:

a. Capital units are homogenous. b. No uncertainties. c. No adjustment costs.

d. Investment decisions are flexible before and after the decisions are taken.

e. Marginal productivity of labour and capital are positive.

y = AK^αL^1-α

Equilibrium would be attained were MPK = r/P

Where, r = rental, P = Price Level, and r/P = user cost

If MPK > r/P Invest

If MPK < r/P Not invest

Tobin’s Q Theory:

The theory was given in 1969.

𝐓𝐨𝐛𝐢𝐧 𝐐 = 𝐌𝐚𝐫𝐤𝐞𝐭 𝐯𝐚𝐥𝐮𝐞 𝐨𝐟 𝐢𝐧𝐬𝐭𝐚𝐥𝐥𝐞𝐝 𝐜𝐚𝐩𝐢𝐭𝐚𝐥 / 𝐑𝐞𝐩𝐥𝐚𝐜𝐞𝐦𝐞𝐧𝐭 𝐯𝐚𝐥𝐮𝐞 (𝐜𝐨𝐬𝐭)

If Q > 1 Invest because market valuation is higher

If Q < 1 Disinvest because cost is higher

Cash Flow Theory: Given by Duessenberry

MULTIPLIER

The first concept of multiplier was given by R.F. Kahn in 1931, namely Employment

Multiplier. Employment multiplier shows the impact on total employment with increase in

primary employment.

Investment Multiplier

The concept was given by Keynes and is also known as ‘Closed Economy Multiplier’. The

investment multiplier shows the change in income due to change in investment.

According to Keynes, repeated investment needs to be done.

Assumptions taken by Keynes were:

1. MPC constant 2. Closed economy

3. Ignored induced investment and accelerator effect.

4. Excess capacity in consumer goods industry.

5. No excess capacity in production sector.

Main features of investment multiplier are:

1. Higher MPC implies higher value of multiplier.

2. Multiplier can reduce due to leakages like savings, government taxes, imports, etc.

3. Value of the multiplier lies between 1 and infinity.

Foreign Trade Multiplier

The foreign trade multiplier implies that with increase in exports, what is the impact on income,

that is by how much does the income increase.

𝐅𝐨𝐫𝐞𝐢𝐠𝐧 𝐓𝐫𝐚𝐝𝐞 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = Δ𝐘 / Δ𝐗 = 𝟏 / 𝐌𝐏𝐌 + 𝐌𝐏𝐒

❑ Keynes Multiplier > Foreign Trade Multiplier

Super Multiplier

The concept of Super Multiplier was given by Hicks.

He considered both induced and autonomous investment.

Change in autonomous investment→ Change in income →Change in induced investment

I = A + iy

Where i = propensity to invest, A is the Autonomous investment, y = income.

𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = 𝟏 / 𝐌𝐏𝐒 − 𝐌𝐏𝐈

Where: MPI = Marginal Propensity to Invest

❑ Super Multiplier > Investment Multiplier

Balanced Budget Multiplier

• Taxes are only autonomous and lump sum.

• Government purchases of goods and services are included and not the transfer payments.

• Government expenditure and tax do not affect the investment activity.

1. Government Purchases Multiplier: It reflects the change in income due to change in

government expenditure.

Δ𝐘 / Δ𝐆 = 𝟏 / 𝟏 − 𝐛

Where b = MPC

2. Tax Multiplier: It reflects the change in income due to change in taxes.

Δ𝐘 / Δ𝐓 = −𝐛 / 𝟏 − 𝐛

❑ Taxes imposed will reduce the consumption partially.

❑ Tax Multiplier < Government Multiplier

3. Balanced Budget Multiplier

𝐁𝐚𝐥𝐚𝐧𝐜𝐞𝐝 𝐁𝐮𝐝𝐠𝐞𝐭 𝐦𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 = 𝐆𝐨𝐯𝐞𝐫𝐧𝐦𝐞𝐧𝐭 𝐦𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫 + 𝐓𝐚𝐱 𝐌𝐮𝐥𝐭𝐢𝐩𝐥𝐢𝐞𝐫

𝟏 /𝟏 − 𝐛 + −𝐛 /𝟏 − 𝐛 = 𝟏

Transfer Payments Multiplier = 𝒃 / 𝟏−𝒃

❑ Balanced budget multiplier is equal to one only in case of lump sum taxes. In case of

proportional tax, the balanced budget multiplier is less than 1.

TRADE CYCLES

• Trade Cycles are the alternate phases of business activity.

• They are universal, periodic and synchronous in nature.

• Profits are majorly affected by Trade cycles.

Boom: It is the peak level, that is, the topmost level

of expansionary phase. The economy experiences this

phase when it has crossed the full employment level.

At one side, when the economy shows signs of

prosperity, on the other hand, boom is a symptom

of downswing.

Recession (Upper turning point): The stage lies between

prosperity and depression. The process followed under this is:

Increase in interest rate → Decrease in Investment → Decrease in Income

→ Shut down the production

Theories of Trade Cycle

1. Samuelson’s Theory of Trade Cycle: The theory was given in 1939. Samuelson used the

concepts of both multiplier and accelerator.

❑ According to him,

Increase in autonomous investment → Increase in income (due to effect of multiplier)

→ Increase in induced investment (due to the effect of accelerator)

❑ According to Samuelson, cycles can be explosive in nature. He assumed different values of

multiplier and accelerator and considered a one period lag. Also he treated MPC to be

constant.

❑ Samuelson talked about 4situations:

1. Cycleless Growth Path: It goes away from the equilibrium path, either in increasing direction

or decreasing direction. MPC = 0.5 Accelerator = 0

2. Damped Fluctuations/ Oscillations: Magnitude is decreasing. It is not consistent with real

situations. MPC = 0.5 and Accelerator = 1

3. Constant Amplitude Cycle: It is not realistic.

MPC = 0.5 and Accelerator = 2

4. Anti-damped/ Explosive Cycles: It assumes no buffers could control the cycles.

MPC = 0.5 and Accelerator = 3

Hicks’ Theory of Trade Cycle:

The theory was given in 1950 in Hicks work namely “A Contribution to the Theory of Trade

Cycles”.

❑ His theory is also known as “Constrained Cycles Theory”. He used buffers in his theory and

stated that both the multiplier and the accelerator will lead to the generation of cycles.

❑ However, according to him, the explosive cycles can be controlled, which was not given in the

theory by Samuelson.

Where:

Max Y = Full employment ceiling level Y* = Equilibrium

growth path

Min Y = Floor ceiling/ slump equilibrium

I0ent = Autonomous Investment: It is determined by

capital stock. It determined the quantum of labour with

the help of multiplier.

Growth path would be determined by multiplier and accelerator.

In the diagram, movement from:

1 to 2: Expansion

2 to 3: Boom (Investment lag): Investment lag occurs because investment does not increase with

that pace as compared to the Growth path

3 to 4: Recession

5 to 6: Depression (represents excess capacity)

6 to 7: Recovery

Kaldor’s Theory “A model of Trade Cycle”: The theory was given in 1940. Kaldor uses the

concepts of savings and investment in the ex-ante form. He assumes a non-linear saving and

investment curve because they cannot be treated as constant. Moreover, with linear functions, the

trade cycles won’t be reflected.

Kaldor also stated that trade cycles are self-generating.

❑ Points b, c are the points of stable equilibrium and a is the

point of unstable equilibrium.

❑ Expansion process will generate when a and c are in the

process of co-incidence and will stop when these points coincide.

QUESTIONS FOR CLARIFICATIONS

1. Who first used the multiplier relationship together with the key role played by

unstable investment, which he expressed in terms of the accelerator theory of

investment to construct cumulative upwards and downwards movements in real

output?

A) Hicks B) Samuelson

C) Keynes D) Harrod

2.The effect of monetary and fiscal policies on private sector’s demand for goods

and financial assets must be taken into account if there is to be a complete and

consistent analysis of policy. This was first stated by:

A) D.J. Ott and A.F. Ott

B) D. Laldler and M. Parkin

C) G. Maynard and W.Van Ryckeghem

D) D. Purdy and G. Zis

3. Tinbergen rule of economic policy states that if government has ‘n’ independent

targets, it must then have at least ------- effective instrumental variables if it is to

achieve all the targets.

A) n-1 B) n+1 C) n+2 D) n

4. The new classical writers point to the repeated breakdown of econometric models

because:

A) Structural coefficients cannot be treated as invariant

B) Investment is related to interest rate

C) Existence of underemployment in the economy D) None of the above

5. Relative Income Hypothesis is propounded by:

A) M. Friedman B) J.M. Keynes

C) Duesenbery D) Modigliani

6. The cost of employing the services of a unit of capital includes:

A) Interest charged on the price of one unit of capital stock

B) Depreciation charge C) Rise in the price of a unit of capital stock

D) All the above

7. The stability of demand for money is seen as a crucial theoretical and empirical

idea for the:

A) Keynesians B) Post Keynesians

C) Monetarists D) New Keynesians

Answers:-

1) A 2) B 3) D 4) A 5) C 6) D 7) C

PHILLIPS CURVE

The concept of Phillips Curve was given by A.W. Phillips in 1958.

❑ Originally the relationship was estimated between wages and unemployment. It was stated

that there is a negative relationship between the two.

❑ If workers can push the wages beyond their productivity, then it will lead to the change in

price level.

Δ𝐖 / 𝐖 > Δ𝐲 / 𝐲

i.e., Δ𝐏 / 𝐏

❑ Later on, Phillips curve was established showing a negative relationship between rate of

inflation and rate of unemployment

• It is downward sloping and takes the shape of a rectangular hyperbola

Theoretical Explanations for trade-off between Rate of price level (ΔP/P) and Rate of

unemployment (ΔU/U)

1. Lipsey (1960): According to Lipsey, wages are directly related with excess demand.

Unemployment and excess demand are inversely related.

W = f (Nd – Ns)

Where: Nd = Demand for labour, Ns = Supply of labour,

Nd – Ns = Excess demand for labour, W = Wages.

2. Phelps: Phelps gave a theory named “Theory of Collective bargaining/ Trade Unionisation”.

❑ According to him, monetary settlements are through collective bargaining. Wages are

indirectly related to unemployment.

High unemployment rate →Less power with the trade union→ Decrease in wages

Keynes Dynamic analysis of price-output determination:

❑ According to Keynes, if there is an increase in aggregate demand, it will be distributed

between price level and unemployment. In other words, with increase in aggregate demand,

the price level will increase, while unemployment rate will decrease.

Policy Implications of Philips Curve

Expansionary: Increase in Inflation, Decrease in Unemployment

Contractionary: Decrease in Inflation, Increase in Unemployment

Long Run Phillips Curve

The Long-Run Phillips Curve was given by Milton Friedman.

It is also known as Augmented Phillips Curve or Adaptive Expectations Phillips Curve.

W = U + λPte

Where: W = Wages, U = Unemployment, λ = Speed of adjustment,

Pte = Price expectations.

λ = 1 would imply perfect expectations

λ = 0 in the short run

λ < 1, according to Tobin.

Natural Rate of Unemployment (NRU):

The concept of NRU was given by Milton Friedman while it was given a new name by Tobin which

is “Non-Accelerating Inflation Rate of Unemployment (NAIRU)”.

It is the rate at which there is no gap between actual and expected inflation. In other words,

inflation is stable at that point.

❑ Suppose if we adopt expansionary policy. The

unemployment would reduce to U2 level and inflation

is 3.5%. So labour will demand wages according to 3.5%

because they haven’t realised the inflation. But when

they do, they demand higher wages and Phillips curve

would then shift to SRPC 2. Long run Phillips curve will

show that there is no trade off between inflation rate

and unemployment rate. Any change in the policy would

only lead to increase in the inflation rate.

Ekstein-Brinner’s Phillips Curve:

According to this, there is no trade-off till NAU but beyond that there is a trade-off.

Decrease in unemployment rate below the natural rate is possible only if there is a time lag

between money wages and price levels.

Stagflation is a situation in which prices increase without increase in employment and output

levels.

IS-LM MODEL

The IS-LM Model was given by Hicks and Hansen in 1937. It reflects on the simultaneous

integration of the two sectors.

Product Market

IS curve shows equilibrium in the product market.

All the points on the IS curve show Saving = Investment and Aggregate Demand = Aggregate

Supply. Also there is a negative relationship between rate of interest and income.

Fall in rate of interest-→ Increase in Investment→ Increase in Aggregate

Demand→ Increase in income

Slope of IS Curve depends upon:

1. Interest elasticity of Investment Demand:

Small changes in interest rates, lead to larger

changes in Investment. Higher the interest

elasticity of demand, flatter will be the IS curve

and vice versa.

2. Size of the multiplier: More the size of the

multiplier, flatter will be the IS curve and vice-versa.

❑ IS curve shifts when the autonomous elements

Money market

Money market equilibrium is represented by LM Curve. At all points on the LM curve, demand for

money is equal to the supply of money. We assume that the supply of money is exogenously

determined by the bank or Central authority.

We know that, Md = f (y, i)

Money demand is a function of income and rate of interest

i and y are positively related

❑ Increase in income →Demand for money increases

→Sell bonds, which reduces the price of bonds

→Because demand for bonds is now less, the interest

rate increases

Monetary Policy

❑ In the Keynesian range, monetary policy is

completely ineffective and will not change

the rate of interest.

❑ In the intermediate range, policy is less

effective than the classical range and more

effective than the Keynesian range.

❑ In the intermediate range, policy is less

effective than the classical range and more

effective than the Keynesian range.

Fiscal Policy

❑ In the Keynesian range, fiscal policy is

highly effective.

❑ In the Intermediate range, fiscal policy is

less effective as compared to the Keynesian

range and more effective as compared to

the Classical Range.

❑ In the Classical range, fiscal policy is totally

ineffective. Entire impact is on the rate of

interest and no change in income.

NATIONAL INCOME AGGREGATES

GDP → Total Production

GNP = GDP-Net income from Abroad (NFIA)

GDP MP = GNPMP - NFIA

GDP FC = GDPMP – Net Indirect Taxes Net Indirect Tax = Indirect Taxes – subsidies

NNPMP = GDP – Depreciation

NDP = GDP - Depreciation

Real Y = Current year NNP/Current year index 100 National Income = NNPFC

Private Income= National income – Income of Govt. Cos. Savings of Non- Dept. Enterprises +

Interest on National debt + Net Current transfers from Govt. + Net

current transfers from abroad.

Personal Income = Private Y- Undistributed profits of enterprises – Corp. Tax – retained

earnings of foreign Cos.

Personal Disposable Y = Personal income – Personal Income Taxes – Misc. Receipt of the Govt.

Admin. Depts.

QUESTIONS FOR CLARIFICATION

1. The long run relationship between inflation and interest rates is called:

A) Keynes Effect B) Pigou Effect

C) Fischer Effect D) Patinkin Effect

2. GDP at market prices:

A) Includes indirect taxes and subsidies

B) Excludes indirect taxes but includes subsidies

C) Includes indirect taxes and excludes subsidies

D) Excludes both indirect taxes and subsidies

3. The tendency of increase in government spending to cause reductions in private

investment spending is:

A) Crowding–in effect B) Crowding-out effect

C) Cross subsidization D) Fiscal effect

4. Which of the following is not a fiscal measure?

A) Public expenditure B) Interest rate

C) Tax subsidies D) Investment subsidies

5. In a simple Keynesian Model, the open economy multiplier:

A) Is smaller in value than closed economy multiplier

B) Is greater in value than closed economy multiplier

C) Is same as closed economy multiplier

D) Cannot be compared to closed economy multiplier

6. A positive relation between the growth of the population, employment and output on the

one hand and the growth of labour productivity on the other is:

A) Verdoorn’s Law B) Labour Surplus Theory

C) Optimum Population Theory D) Demographic Transition Theory

7. Which of the following statement is not correct?

A) The value of Lorenz ratio ranges in between zero to one

B) The value of HDI ranges in between zero to one

C) The value of PQLI ranges in between one to 100

D) The SLR of RBI ranges in between 5 to 15.

8. Demonstration effect means:

A) Effect of advertisement B) Imitating effect of consumption

C) Effect of entertainment D) Effect of an experiment

Answers:-

1) C 2) C 3) B 4) B 5) A 6) A 7) D 8) B

MONEY

Definition of money

Narrow definition Currency (C) + Demand Deposits (DD)

Broader definition C + DD + Time Deposits (TD)

Gurley-Shaw Approach

According to them, Time Deposit and savings deposit can be substituted

Money = weighted average of all the assets (Weights are given according to their liquidity)

Liquidity Approach/ Central Bank Approach

Given by Radcliff

Money = state of liquidity in the economy.

High powered money →

Currency issued by Central Bank and is supported by Reserves India Adopted Minimum Reserve

System in Oct. 1956

Minimum Reserve System:

Presently 200 crores

→ 115 crore in Gold and other in rupee securities

Measure of High Power Money ss in India

H = C + R + OD

Where, C= Currency held by public, R= Cash Reserves of Commercial Banks

DETERMINANTS OF MONEY SUPPLY

1. Required Reserve Ratio = Sum of currency in the hands of public (c) + Cash Holdings &

deposits at the Central Bank (R)

2. Level of Bank Reserves = reserve ratio Commercial Banks /Deposit Liabilities

3. Public’s Desire to hold currency & deposits

Measures of Money Supply

These measures were adopted by our economy in 1977.

M1 = C + DD + Other deposits

M2 = M1 + Savings with the post office

M3 = M1 + Time Deposits

M4 = M3 + Post office savings (excluding NSC)

Liquid Resources

L1 = New M3 + All deposits of Post Office savings Banks excluding NSCs.

L2 = L1 + Term deposits c term lending inst. & refinancing inst. + term borrowing by FIs.

L3 = L2 + Public deposits of non-banking financial inst.

Money Multiplier

M = mH

Where: M = money supply, m = money multiplier, H = High Powered money

M = C + DD

H = C + Reserves (R)

R = Required reserves + excess reserves

❑ Money multiplier ‘m’ tell us that with change in H, how much will the money supply in the

economy change.

Determinants of Money multiplier

𝐌/ 𝐇 = 𝐂 + 𝐃 / 𝐂 + 𝐑

1. C/D is the currency deposit ratio which has a negative relationship with the money supply.

2. R/D is the reserve deposit ratio and has a negative relation with the money supply.

3. Proximate/Ultimate factors: like CRR, SLR, affect C/D, R/D

Systems of Money

1. Barter System: Exchange in terms of goods which was known as commodity money.

Problems under this system was:

• No durability

• No portability

• Not homogenous

2. Metallic Coins: It is a full bodied money. Money value is equal to the intrinsic value or

commodity money.

3. Credit Money: Commodity value is nil. Money value if much greater than commodity value.

INFLATION

Creeping Inflation Around 3%

Trotting inflation/Crawling/ walking 3-7 percent or less than 10%

Running Inflation 10-20%

Hyperinflation/Runaway inflation Above 20%

Causes of Inflation

1. Excess demand: According to monetarists, with the increase in money supply, there would be

a rise in the price level.

On the other hand, Keynesians stated that price would rise only after demand reaches income.

2. Cost push inflation: Cost of production increases.

Studies with respect to trade union activities.

3. Profit-push inflation:

It is also known as Administered pricing inflation or pricing power inflation.

It is studied from the employer’s side who increase the price above the cost of production to

increase their own profits.

4. Structural inflation: It is caused due to rigidities in the economy.

5. Mark-up inflation: It was given by Professor Ackley.

Wages of workers are administered by labour and employers together.

Employers keep price above the cost. On the other hand, labour keeps a mark up of its wages

above their minimum living requirements.

6. Sectoral Inflation/Demand shift rigidities: It was given by Charles Schultz. Such kind of an

inflation is caused due to downward rigidities in wages. If there is excess demand, prices increase

and in case of deficient demand, prices decrease. Overall, the net result is the increase in price.

Open Inflation: In this, the government doesn’t interfere. Activities are left on the market forces.

Suppress Inflation: It is the case in which open inflation is controlled by the government by

imposing monetary or fiscal limits.

Reflation: Occurs at times of recession/depression.

Government adopts the policies to increase the prices.

Core inflation: Also known as underlying inflation.

It is the inflation not accounting for volatile price movements, particularly food

and energy prices.

Headline inflation/topline inflation: Includes all the volatile inflation. It accounts for

everything which affects the cost of living.

AGGREGATE DEMAND AND AGGREGATE SUPPLY

Aggregate Demand

The curve slopes downwards because:

1. Real Balance Effect: If there is a decrease in

price, people become better off and hence

demand more quantity.

2. Rate of interest effect: Decrease in price

→demand for money decreases →rate of

interest decreases →Investment increases

→Aggregate demand increases

3. Net export effect: Decline in price, leads to increase in exports and hence the aggregate

demand increases.

Aggregate Supply: Aggregate supply curve is upward sloping because of nominal wage

rigidities in the short run.

AD curve shifts due to changes in government expenditure, investment and net exports. On the

other hand, AS curve shifts due to change in technology, input prices, taxes or subsidies.

Sticky Wage Model: By Lucas

𝐲 = 𝐲̅ + 𝛂(𝐏 − 𝐏^𝐞)

y = aggregate output

𝑦̅̅= Potential GDP (Labour market equilibrium, that is, NRU achieved)

α = Rate at which output is changing with change in prices

P = Price level P^e = Expected Price level

❑ The aggregate supply curve is a vertical curve in the long run because the money wages are

not sticky then. They are rather flexible so they keep the real quantity constant.

❑ If money wages increase, prices also increase and hence relative quantities remain stable.

❑ In the long run, macro-economic equilibrium will be established where equality is achieved

between aggregate demand, short run aggregate supply and long run aggregate supply.

It is the point where:

1. Real GDP = Potential GDP

2. P = Pe

3. Actual unemployment rate = Natural

rate of Unemployment (NRU)

In long run, money wages help in establishing

equilibrium because they are flexible.

NRU = Structural unemployment + Frictional Unemployment

EFFECTIVE DEMAND

Point where AD curve intersects AS

Effective demand determines the level of income & employment. Lack of effective demand →

unemployment.

Total effective demand includes :-

1. demand for consumption goods or consumption demand.

2. Demand for capital goods or Investment demand

Increase in consumption demand > Increase in total income → unemployment.

PATINKIN’S INTEGRATION OF MONETARY AND VALUE THEORY

THE REAL BALANCE EFFECT

Work “Money, Interest & Prices” : Book by Don Patinkin

❑ According to the theory, Demand & supply of goods are affected only by relative prices.

Money prices have no effect on demand & supply of goods implying Demand & supply

functions for goods are homogenous of degree zero. When prices level changes, purchasing

power of cash holdings will also changes which affects demand and supply of goods.

❑ This process is known as the REAL BALANCE EFFECT.

❑ Increase in price level →Decrease in real balance →Increase in Demand

PARADOX OF THRIFT

People save → Decrease in Consumption → Decrease in Standard of living.

This leads to decrease in economic growth Deposit multiplier = (1/r)*(D) ,

where D = Deposits of the Bank and

r = Required cash reserve ratio

FUNCTIONS OF MONEY

Primary functions Secondary functions Contingent functions

1. Medium of exchange Std. of deferred payment Distribution of NY

2. Medium of exchange Store of value Equating of MU

3. Measure of value Transfer of value Basis of credit

Liquidity to Wealth

QUESTIONS FOR CLARIFICATION

1. Negative net work externality in which a consumer wishes to own an exclusive or unique good

A) Demonstration Effect B) Ratchet Effect

C) Pigou Effect D) Snob Effect

2. Tobin’s Q is positive when the revenue from a unit of output produced by hiring

additional capital is -------

A) greater than the rental on capital.

B) lower than the rental on capital.

C) equal to the rental on capital.

D) None of the above

3. The demand for real money balances ----- with income and ----- with a rise in

interest rates

A) declines, rises B) rises, rises

C) declines, declines D) rises, declines

4. The assumption that money wages are fixed and that employment is determined by the short

side of the labour market, which is usually the demand for labour side results in

A) A downward sloping aggregate supply of output curve

B) An upward sloping aggregate supply of output curve

C) A vertical aggregate supply of output curve

D) None of the above

5. Under the Keynesian policy analysis, fiscal policy multiplier is larger when:

A) The more interest elastic is the demand for money and less interest elastic is the demand for

investment goods

B) The less interest elastic is the demand for money and less interest elastic is the demand for

investment goods

C) The more interest elastic is the demand for money and more interest elastic is the demand for

investment goods

D) The less interest elastic is the demand for money and more interest elastic is the demand for

investment goods

6. An increase in taxes will shift the

A) IS curve to the right and increase both the interest rate and the level of income

B) IS curve to the left and decrease both the interest rate and the level of income

C) IS curve to the right and increase the level of income but decrease the interest rate

D) LM curve downward to the right and increase the level of income but decrease the interest rate

7. When the rate of inflation is declining, there is

A) Reflation B) Deflation

C) Disinflation D) None of the above

Answers:-

1) D 2) A 3) D 4) B 5) A 6) B 7) C